PROPERTY MARKET TRENDS | 4Q 2020

This report describes a real estate market in which improving trends are emerging in some categories, despite the prolonged COVID-19 pandemic.

PROPERTY MARKET TRENDS | 4Q 2020

Even though the COVID-19 situation continues, the logistics market, which is experiencing unprecedented demand, and the recovering residential market are driving the market as a whole.

While the Japanese real estate market, as well as the stock market, experienced a vigorous inflow of capital from overseas, Tokyo was ranked third (at USD 22.7 billion), just below first-ranked Paris (at USD 23.1 billion), among the global cities by investment amount through 2020.

TEXT: Yoko Fujinami, IBRC Inc.

Toru Kawana, Industrial Marketing Consultants Co., Ltd.

J-REIT

J-REIT Index rose toward the end of 2020, and assets under management reached JPY 20 trillion.Efforts to reorganize portfolios in hard-hit categories

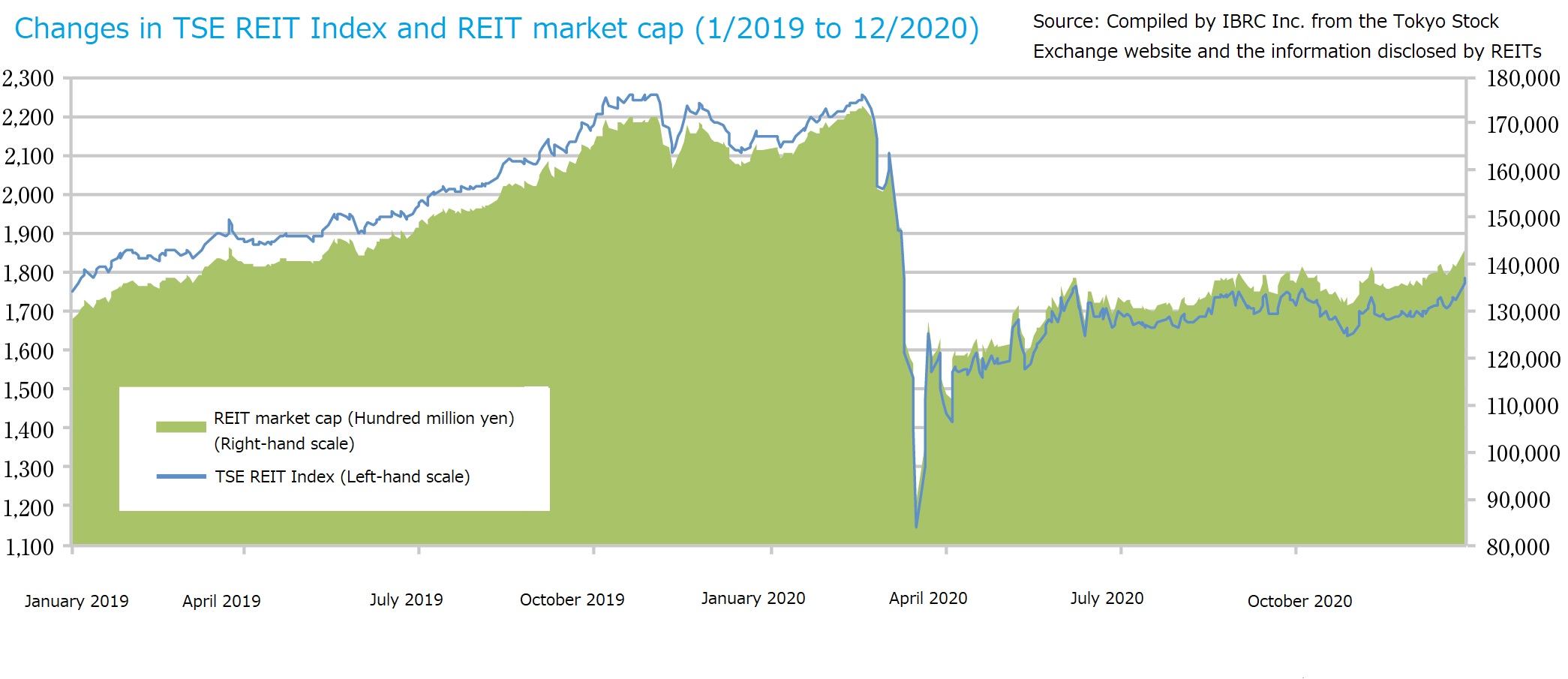

At the end of December 2020, the TSE REIT Index was up by 57.24 points from September, to 1,783.90 points, while the market capitalization of the REIT market as a whole was up by JPY 738.9 billion from September, to JPY 14.3974 trillion. While the TSE REIT Index had been staggering in a boxed range around 1,700 points since June, it rose along with the stock market toward the end of the year, to reach a new high since the COVID-19 shock in March. Aggregate assets under management of the whole J-REIT market grew by JPY 318.9 billion from the end of September to hit JPY 20.2862 trillion, exceeding the JPY 20 trillion level after 19 years since its inauguration.

The REIT market in 4Q (October-December) showed a sharp contrast among property types, reflecting the impact of the ongoing COVID-19 pandemic. Logistics REITs actively acquired properties with a series of capital increases backed by favorable market conditions in investment units and the leasing environment. Among Residential REITs, there was a common trend to realize gains on dispositions, helped by favorable trading conditions, even though occupancy rates in central cities decreased because of an outflow of population to the suburbs.

Among Hospitality REITs, there were increasing cases of changing operators who were found inadequate to continue operation, amid severe conditions including the rebound of infection in November and suspension of the Go To Travel Campaign. As far as Commercial REITs were concerned, urban facilities with food & beverage tenants experienced a temporary drop in revenues due to rent reductions and waivers, while suburban facilities maintained a solid sales figure.

While Office REITs underwent a pronounced decrease in occupancy rates due to such factors as worsening corporate business performance and the spread of remote working, there was a tendency to replace properties with those of higher quality in terms of location, age, facilities, and environment. The trend among Compound-type REITs is to develop highly defensive portfolios with emphasis on residential and logistics properties, while refraining from acquisition of hotels and retail facilities.

Office

Market strategies considered essential in light of the rush of newly completed office buildings anticipated a few years from now.

Impacts of COVID-19 and work-style reforms are surfacing.

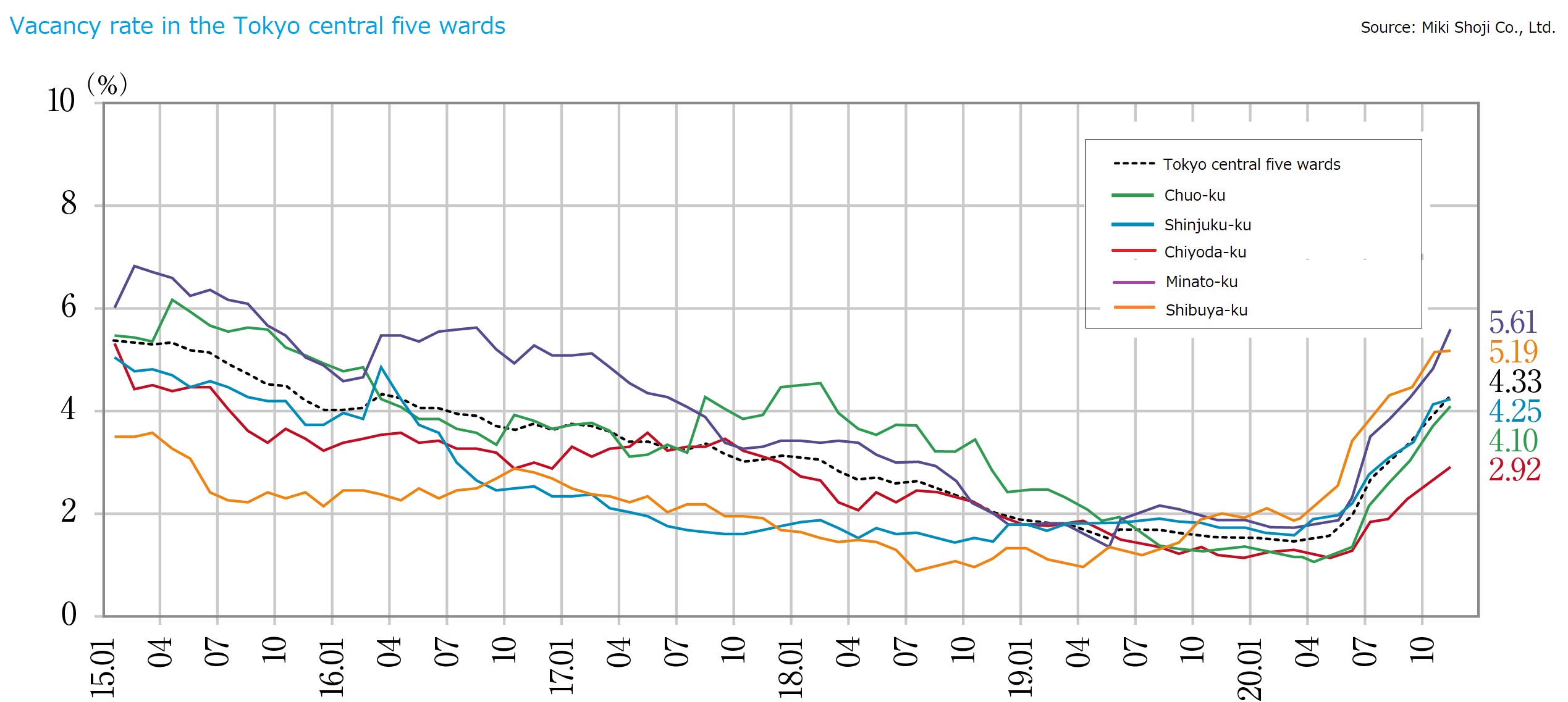

Vacancy rate among large-scale office buildings in Tokyo CBD (five central wards) continued to climb for 11 months in a row, reaching in the last 3 months 3.93% (October), 4.33% (November), and 4.49% (December), while average rent fell for 5 consecutive months to JPY 21,999/tsubo (December), down by 1.01% (JPY 207/tsubo) from the previous month.

Even though an increase in vacancies in Tokyo CBD as a whole in December was contained at about 12,000 tsubo, thanks to fewer lease terminations and conclusion of some small-scale leases during that month, the market remained slow, as evidenced by the fact that one newly constructed office building opened with a certain amount of space uncommitted. While most of newly constructed office buildings opened with a high occupancy rate in January, cases of lease cancellation due to consolidation of office space by tenants and large space becoming available were found in existing buildings.

Here are changes in vacancy rate and average rent by area during 4Q (October-December) 2020: vacancy rate from 2.67% to 3.23% and average rent from JPY 23,892/tsubo to JPY 23,622/tsubo in Chiyoda-ku, vacancy rate from 3.73% to 4.13% and average rent from JPY 20,184/tsubo to JPY 19,723/tsubo in Chuo-ku, vacancy rate from 4.84% to 5.79% and average rent from JPY 22,806/tsubo to JPY 22,316/tsubo in Minato-ku, vacancy rate from 4.12% to 4.17% and average rent from JPY 20,151/tsubo to JPY 19,943/tsubo in Shinjuku-ku, vacancy rate from 5.14% to 5.34% and average rent from JPY 24,635/tsubo to JPY 23,816/tsubo in Shibuya-ku, respectively. The escalation in vacant space in these five wards through 2020 (January-December) were 47,187 tsubo in Chiyoda-ku, 40,251 tsubo in Chuo-ku, 100,543 tsubo in Minato-ku, 25,048 tsubo in Shinjuku-ku, and 21,257 tsubo in Shibuya-ku, all of which summed up to 230,000 tsubo approximately.

Percentage of office buildings with vacancies were 34.04% (vs. 14.89% in the same month a year ago) for the Tokyo CBD as a whole, 32.91% (vs. 15.35% in the same month a year ago) in Chiyoda-ku, 26.48% (10.44% in the same month a year ago) in Chuo-ku, 38.76% (16.93% in the same month a year ago) in Minato-ku, 33.13% (16.01% in the same month a year ago) in Shinjuku-ku, and 41.69% (17.26% in the same month a year ago) in Shibuya-ku, respectively. Thus, the percentage of fully occupied buildings is decreasing, and about one-third of all office buildings has vacancies.

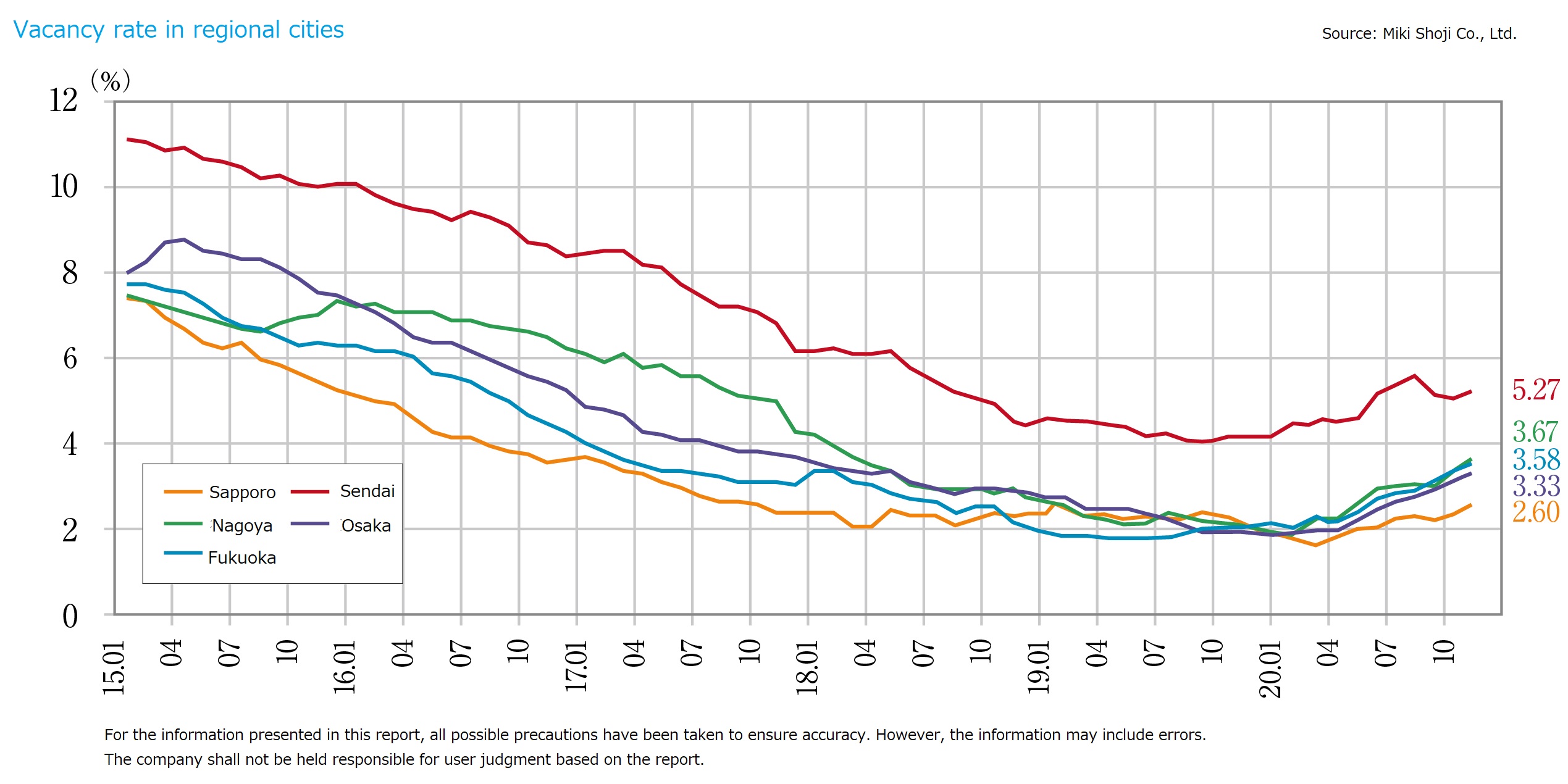

The 4Q (October-December) 2020 changes in vacancy rate in regional markets were as follows: from 2.38% to 2.66% in Sapporo, 5.10% to 5.51% in Sendai, 3.76% to 3.85% in Yokohama, 3.39% to 3.80% in Nagoya, 3.14% to 3.44% in Osaka, and 3.40% to 3.87% in Fukuoka, respectively. There were slight increases in vacancy rate across the all regional cities, but the negative impact from COVID 19 was less significant than in the Tokyo CBD. Changes in average rents per tsubo were: from JPY 9,430 to JPY 9,468 in Sapporo, from JPY 9,337 to JPY 9,316 in Sendai, from JPY 12,249 to JPY 12,271 in Yokohama, from JPY 11,836 to JPY 11,819 in Nagoya, from JPY 11,928 to JPY 11,925 in Osaka, and from JPY 11,028 to JPY 11,086 in Fukuoka, respectively. Average rent increased in Sapporo, Yokohama, and Fukuoka, while decreases in Sendai, Nagoya, and Osaka were modest.

The effects of work-style reforms spurred by the spread of COVID-19 such as promotion of remote working, and decentralization and distribution of head-office functions have been felt in each region. However, the direction of the move is contrasting between the central Tokyo and regional markets; e.g. outflow from Tokyo market vs. inflow to regional markets.

Major corporations with advanced ICT programs in Tokyo tend to successfully implement the shift toward remote working and find more and more spaces left unused. Recently some of them have begun slimming down their office space through such means as the sale of company-owned office buildings and leasing out of unused spaces.

Rising vacancy rate in the Tokyo CBD market is unavoidable from now on, as tenant firms that had requested lease terminations since summer 2020 relocate in March, when a fiscal year ends for most of the firms. Besides, there are numerous large-scale new office projects slated for completion in the Tokyo CBD market. According to data announced recently by CBRE, approximately 680,000 tsubo in office space will be supplied as 15 large-scale office buildings with gross floor areas of 2,000 tsubo or more are to be completed in 2023.

Historically annual supply of office space exceeding 400,000 tsubo has been considered “oversupply” in this class (large-scale office buildings), and a decline in number of office workers is projected to continue in the future. Thus, the Tokyo CBD office market must have reached a major turning point, and conditions in which there is a need for measures to boost demand would seem likely to continue.

Hospitality

Luxury hotel projects move onward even amid COVID-19.

Inbound tourism is expected to trigger post-COVID growth

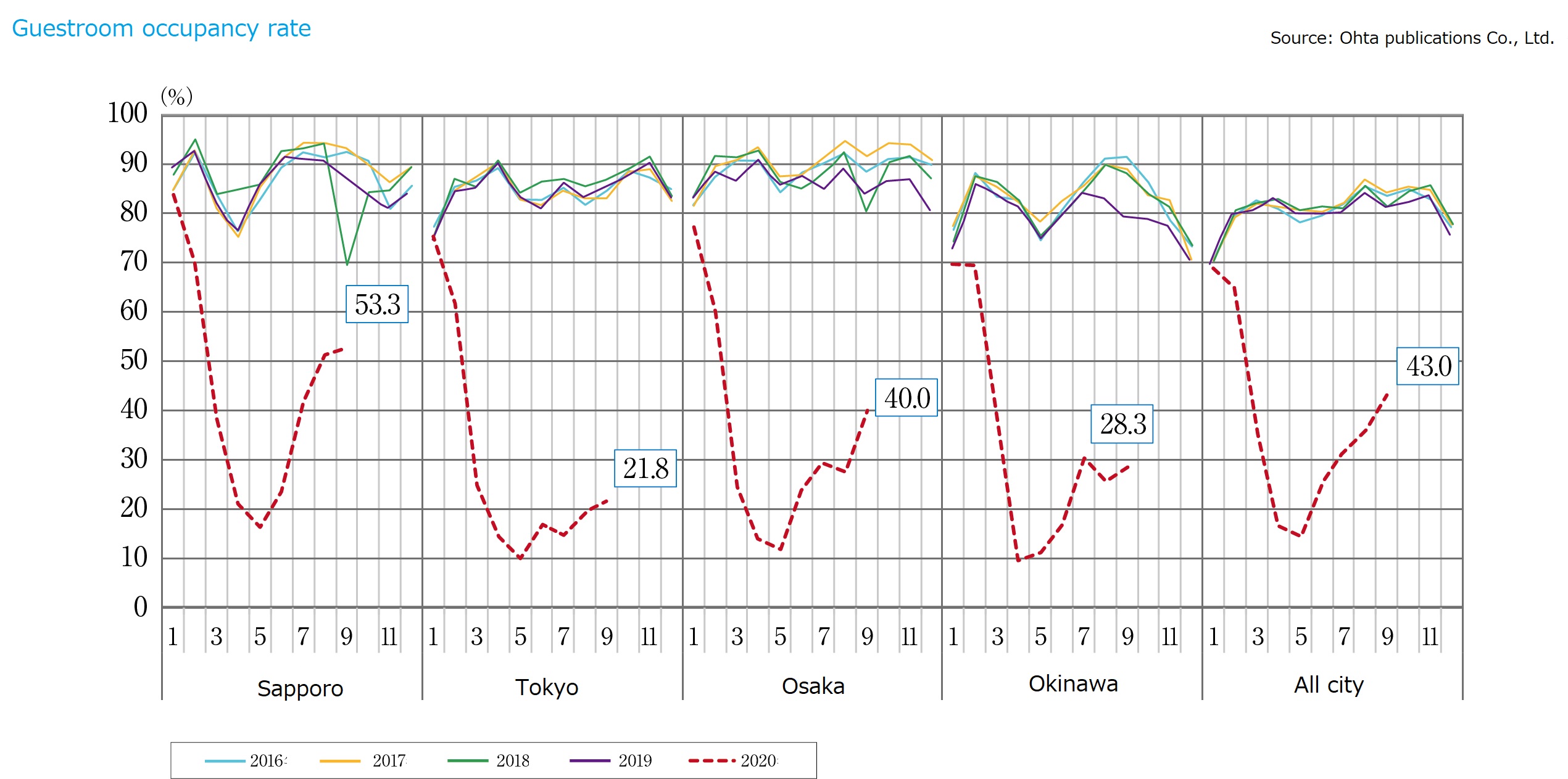

Total number of nights stayed in 4Q (October-December) 2020, announced by the Japan Tourism Agency, was 96.15 million with 32.41 million in October (down 35.2% YoY), 34.5 million in November (down 30.5% YoY), and 29.24 million in December (down 37.9% YoY), respectively. There was an uptick in overnight stays by domestic travelers in the Autumn season 2020 thanks to the Go To Travel Campaign (from 31.42 million in April-June to 73.27 million in July-September) despite the impact from COVID-19. However, that was far from recovery. Guestroom occupancy rates were 42.8% in October, 46.2% in November, and 38.5% in December, respectively. Deterioration of the occupancy rate was evident in December when COVID-19 infection resurged.

The total number of nights stayed by foreign visitors were 510,000 in April-June 2020, 660,000 in July-September, and 1.27 million in October-December. While this reflects an increase due to the resumption in acceptance of business travelers, the figures themselves remain substantially below their previous levels.

According to Ohta Publications Co., Ltd., guestroom occupancy rate of major areas averaged at 43.0% in September 2020 (up 7.4 pt from the previous month). It was 53.3% in Sapporo, 21.8% in Tokyo, 40.0% in Osaka, and 28.3% in Okinawa, showing a clear recovering trend out of the 10% level in April-May. However, the pace of recovery is slower in Tokyo and Okinawa than other areas.

Though the Go To Travel Campaign and other initiatives launched in summer 2020 to buoy up the industry from slump hinted a major recovery, all of those initiatives were suspended in January 2021 in response to the resurgence of COVID-19 spread starting from November. The significant decrease in the number of travelers as a result of it is expected to have a considerable impact on 1Q (January-March).

There were number of cases where hotel development projects, mainly limited-service hotels, were cancelled due to the spread of COVID-19 infection in the spring of 2020. On the other hand, development projects of luxury hotels targeting wealthy inbound tourists, including those started even before the pandemic, are still under way without a hitch in various parts of the country. Luxury hotels, which are used to be alien to Japanese guests, become closer to them thanks to lodging campaigns such as Go To Travel Campaign. In other words, it was the side effect of the Go To Travel Campaign that people who had not experienced before could appreciate hospitality service of a cut above. In any case, it is expected to take some time for the hotel industry to recover. It is hoped that the industry will be able to escape from the impact of COVID-19 as soon as possible, through progress on vaccination and other measures.

Commercial

Suspension of the Go To Campaign hinders efforts toward recovery.

Stay-at-home demand is strong.

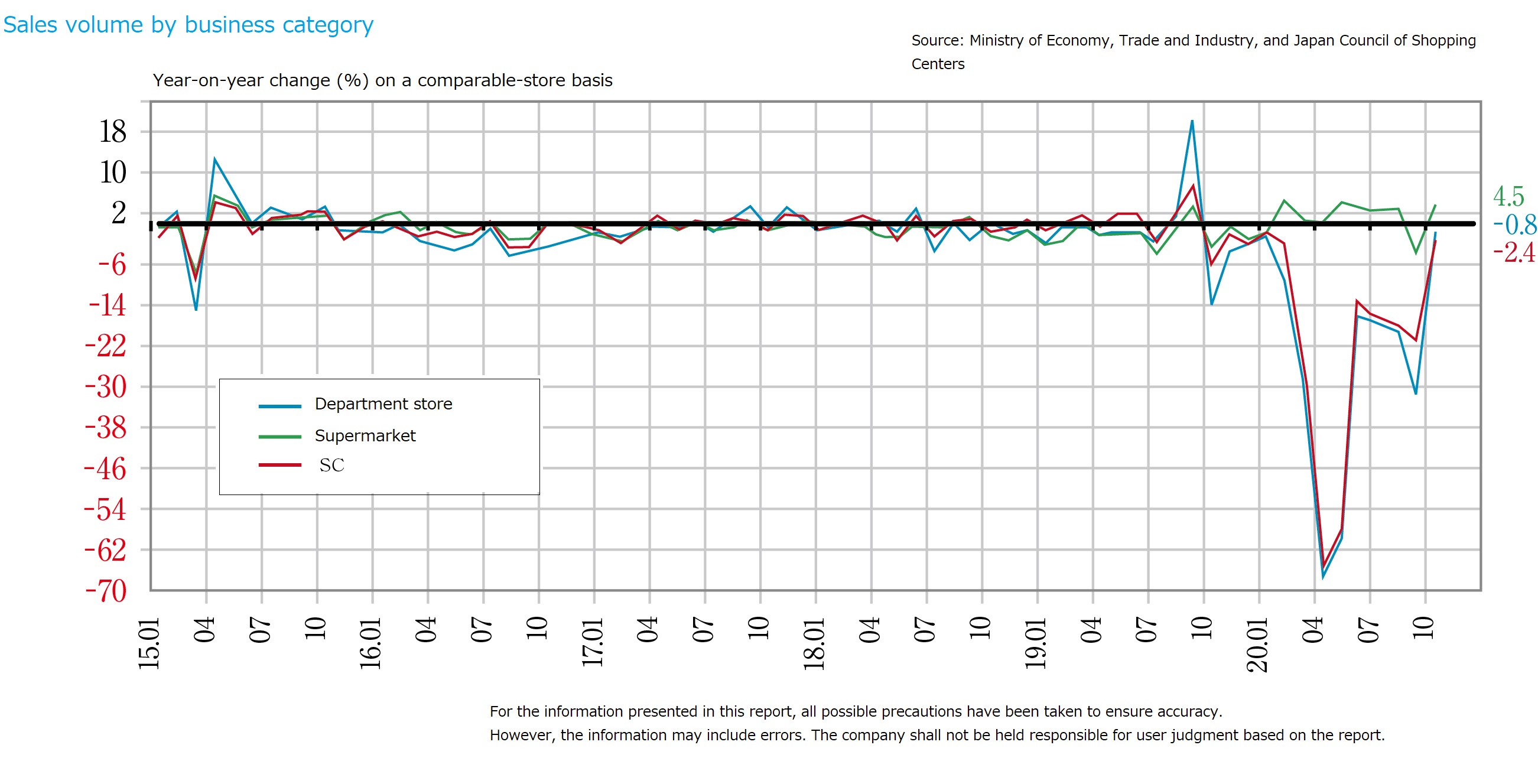

According to Japan Council of Shopping Centers, the same store sales (aggregate) at shopping centers were JPY 474,413,670,000 in October 2020 (down 2.4% YoY), 498,986,860,000 in November (down 11.3% YoY), and 571,918,250,000 in December (down 14.4% YoY). While results were relatively favorable in November, thanks to measures intended to stimulate consumption such as Go To events and premium gift certificates, shopper’s traffic decreased at regional shopping centers and fashion complexes due to hesitation to go out as a number of COVID-19 infection cases rose nationwide in December. To make matters worse, the Go To campaigns were suspended. The consequent decline in the number of tourists and homecoming visitors affected the sales volume during the high shopping season of a year-end, and tough conditions persisted thereafter.

Since another state of emergency was declared in January 2021, the number of customers decreased further, and there would appear to be few prospects for steps toward market recovery.

Here is a look at the latest trends by category in December 2020. Sales of deliverable food products such as Christmas cakes, hors-d'oeuvres, and traditional Japanese New Year’s dishes, were strong as stay-at-home demand rose due to intensifying tendency to refrain from going out. Also, sales of at-home wear and underwear were strong, while those of outerwear were slow. Conditions for food and beverage services remained tough, with increasing restraint on banquets and year-end parties due to the new wave of COVID infection.

The council announced that in 2020 more shopping centers (42) were closed than opened (40) nationwide, when the Japanese government called for self-restraint in going out amid the peak season of year-end and New Year holidays to cope with lingering COVID-19 pandemic. Especially, the impact of COVID-19 has been severe on shopping centers located in urban areas. While conditions have been relatively stable for suburban shopping malls anchored by stores dealing in daily necessities, generally large-scale shopping buildings located at urban termini are struggling.

As far as the tenant mix of 40 shopping centers that opened anew in 2020 is concerned, there is a tendency to follow a recent trend to boost restaurant businesses and lessen merchandise outlets. However, it is getting difficult to maintain food service tenants since they are more severely affected by COVID-19 than retailers. Tenant strategy to attract retail shoppers by creating buzz like ‘The first shop in town’ still remains effective.

The level of a rental income from tenants which used to be achieved by strategically converting to a shopping center is destined to fall as store traffic dwindles, and the business performance of anchor tenants itself is expected to falter. It will be essential to implement new recovery measures promptly while keeping an eye on the progress of COVID-19 countermeasures.

Residential

Suspension of the Go To Campaign hinders efforts toward recovery.

Stay-at-home demand is strong.

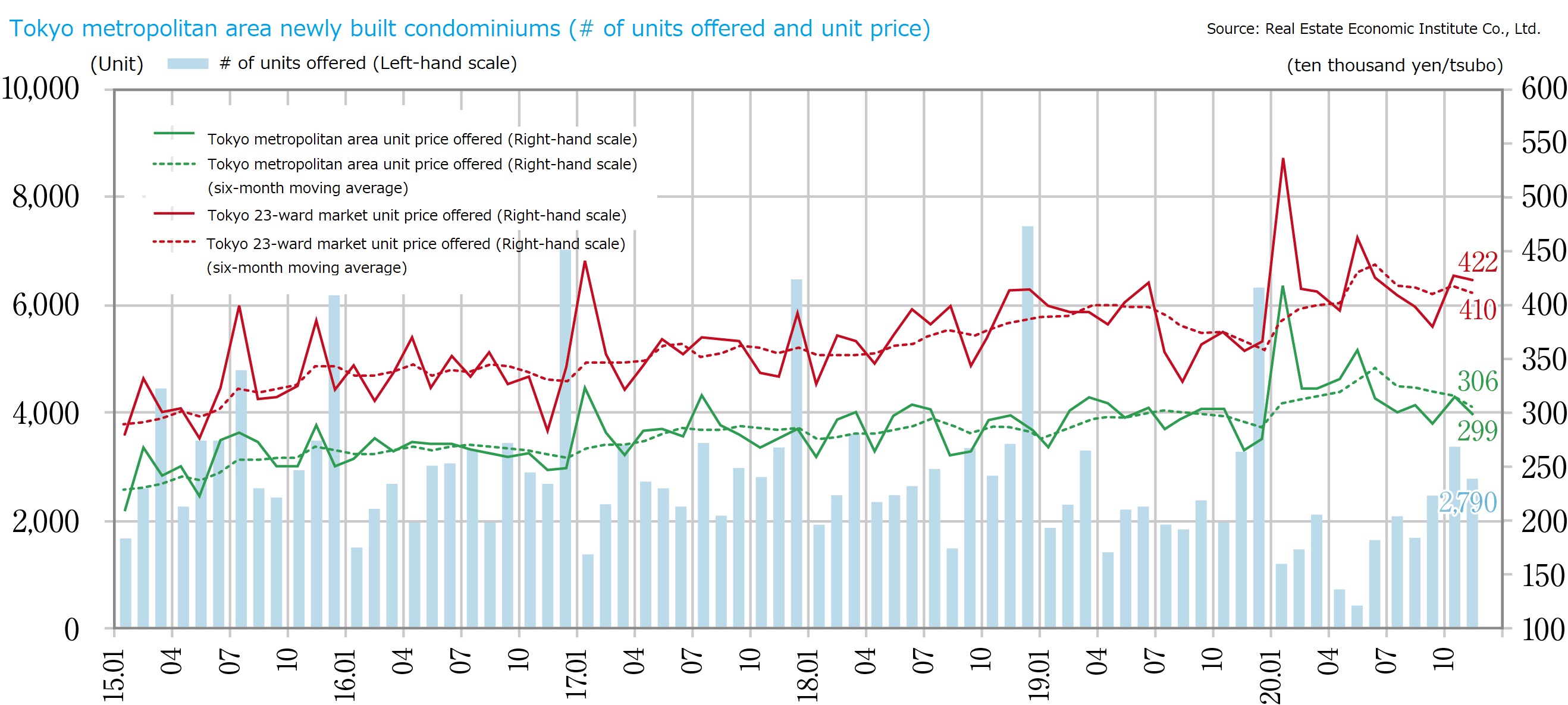

According to Real Estate Economic Institute Co., Ltd., supply of new condominium units in 4Q (October-December) 2020 was 13,510 in the greater Tokyo region (up 15.5% YoY) and 6,130 in the Kinki region (up 2.3% YoY). The average contract rate was 63.6% for the greater Tokyo region and 72.1% in the Kinki region.

Since the institute’s data are adjusted in December, supply tends to increase in 4Q. Still, a sign of recovery in 2H is noticeable.

The number of units supplied, average price, average floor area, and average unit price, respectively, in the greater Tokyo region during January-December 2020 was 27,228 units (down 12.8% YoY), JPY 60.83 million (up 1.7% YoY), 65.7 sqm (down 3.3% YoY), and 3.057 million per tsubo (up 5.2% YoY). The contact rate in the initial month of sales start was 66.0% (up 3.4 pt YoY).

Here are the number of units supplied, average price, average floor area, and average unit price (YoY change) by area: 10,911 units / JPY 77.12 million / 61.6 sqm / JPY 4.135 million per tsubo (+11.4%) in the 23 wards of Tokyo, 3,242 units / JPY 54.6 million / 67.8 sqm / JPY 2.661 million per tsubo (+1.5%) in the suburban Tokyo area, 5,586 units / JPY 54.36 million / 66.4 sqm / JPY 2.704 million per tsubo (+7.9%) in Kanagawa Prefecture, 3,367 units / JPY 45.65 million / 68.4 sqm / JPY 2.205 million per tsubo (+4.2%) in Saitama Prefecture, and 4,122 units / JPY 43.77 million / 71.6 sqm / JPY 2.019 million per tsubo (+1.0%) in Chiba Prefecture. Thus, price increase in the greater Tokyo region is held in check except for the 23 wards of Tokyo and Kanagawa Prefecture where YoY change in unit price exceeds a positive 5% level.

The number of units supplied, average price, average floor area, and average unit price in the Kinki region are 15,195 units (down 15.8% YoY), JPY 41.81 million (up 8.1% YoY), 60.5 sqm (up 6.4% YoY), and JPY 2.284 million per tsubo (up 1.6% YoY). The contract rate in the initial month of sales start was 71.7% (down 2.4 pt YoY). The same set of indices by area are: 5,915 units / JPY 41.3 million / 48.6 sqm / JPY 2.806 million per tsubo (+5.5% YoY) in the city of Osaka, 3,173 units / JPY 44.74 million / 72.1 sqm / JPY 2.049 million per tsubo (+8.4% YoY) in Osaka Prefecture outside of the city, and 1,436 units / JPY 38.42 million / 59.3 sqm / JPY 2.138 million per tsubo (+/-0.0% YoY) in the city of Kobe. Prices in the major areas of the Kinki region are rising by 7-10%, while supply volume has diminished.

According to Real Estate Information Network for East Japan, numbers of secondhand condominium units contracted in the greater Tokyo region during 4Q (October to December) 2020 were 3,686 units (up 31.2% YoY) in October, 3,620 units (up 14.0%) YoY) in November, and 2,533 units (down 9.9% YoY) in December, while the contracted prices averaged at JPY 1.8493 million per tsubo (up 4.8% YoY) in October, JPY 1.87677 million per tsubo (up 3.4%) YoY) in November, and JPY 1.8985 million per tsubo (up 4.8% YoY) in December. Number of sales contracts has been growing as homebuyers are getting more likely to choose secondhand units due to diminishing supply and escalating prices of new condominium units. Contracted prices of the secondhand units are also in an upward trend because of brisk demand.

Furthermore, asking rents of for-rent condominium units in the 23 wards of Tokyo also have been rising since about three years ago, to a current level around the middle of the JPY 12,000/tsubo range. The market rent for a 10-tsubo unit is about JPY 120,000/month, while family-type units at the rent level of around JPY 200,000 per month continue to enjoy high occupancy rates.

Residential market started to recover since summer after a supply curb in both for-sale (new and secondhand) and for-rent units during the first half of 2020 in response to COVID-19 pandemic. While the supply volume of new condominium units has not yet recovered fully, cases of continually strong sales are now observed in high-end properties in central urban areas and of suburban family-type properties. The market condition is improving due to such factors as an increase in number of people looking for more comfort at home and promotion of remote working.

お問い合わせ Contact us

まずは、お気軽にご相談ください。