Quarterly Report for Premium Condominiums in Tokyo | 1Q FY 2025

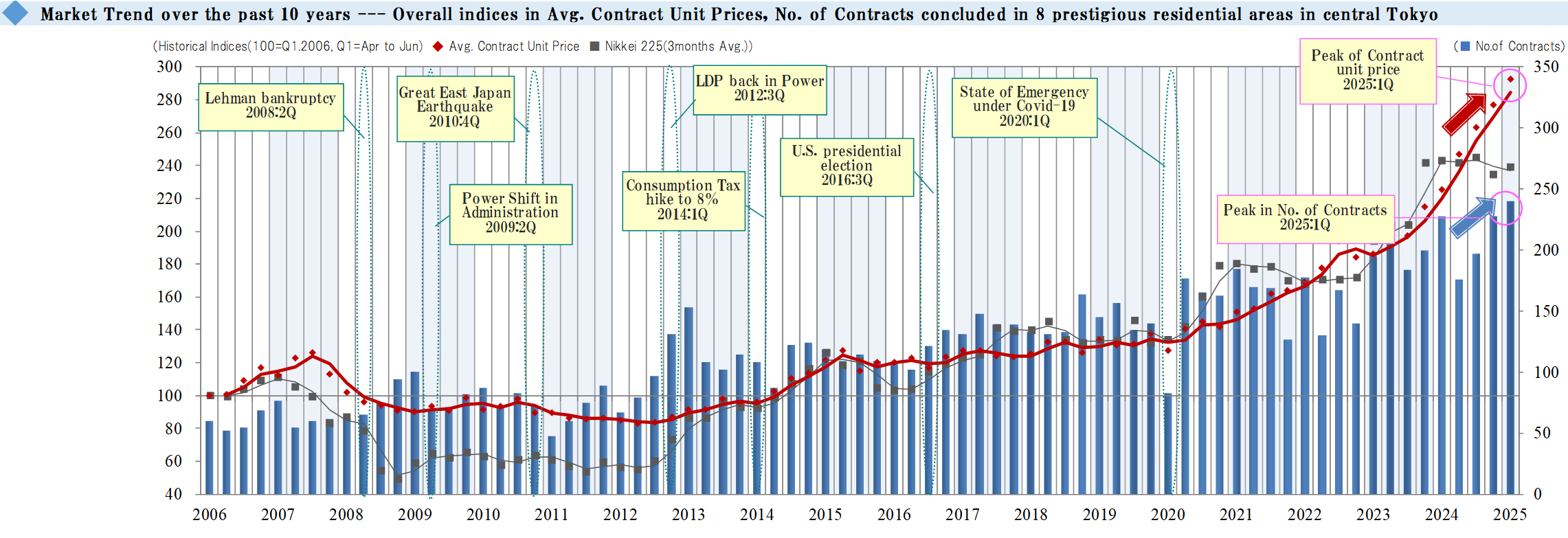

【Chart 1】

This graph shows an index of changes in average contract price per tsubo (*Notes: 1. Indexation using average contract price per tsubo in 1Q / FY 2006 as 100. 2. Tsubo is a Japanese traditional unit of area equal to approx. 3.31sqm.) and the number of contracts concluded every quarter for premium condo. units in 7 prestigious areas of central Tokyo.

Major economic events and Nikkei Stock Average are also shown for reference. The bar graph represents the number of contracts concluded each quarter. The red-line shows a movement in the index of average contract price per tsubo, while the gray-line shows one in the Nikkei stock average.

In the first quarter reviewed here (2025:1Q), the index of the average contract price per tsubo for premium condominium units sold overall rose by +16.0 points QoQ to 292.4, setting a new record since the beginning of data collection for the eighth consecutive quarter. The number of contracts made increased for the third consecutive quarter, rising by 12 QoQ to 240, a new record high since data collection began.

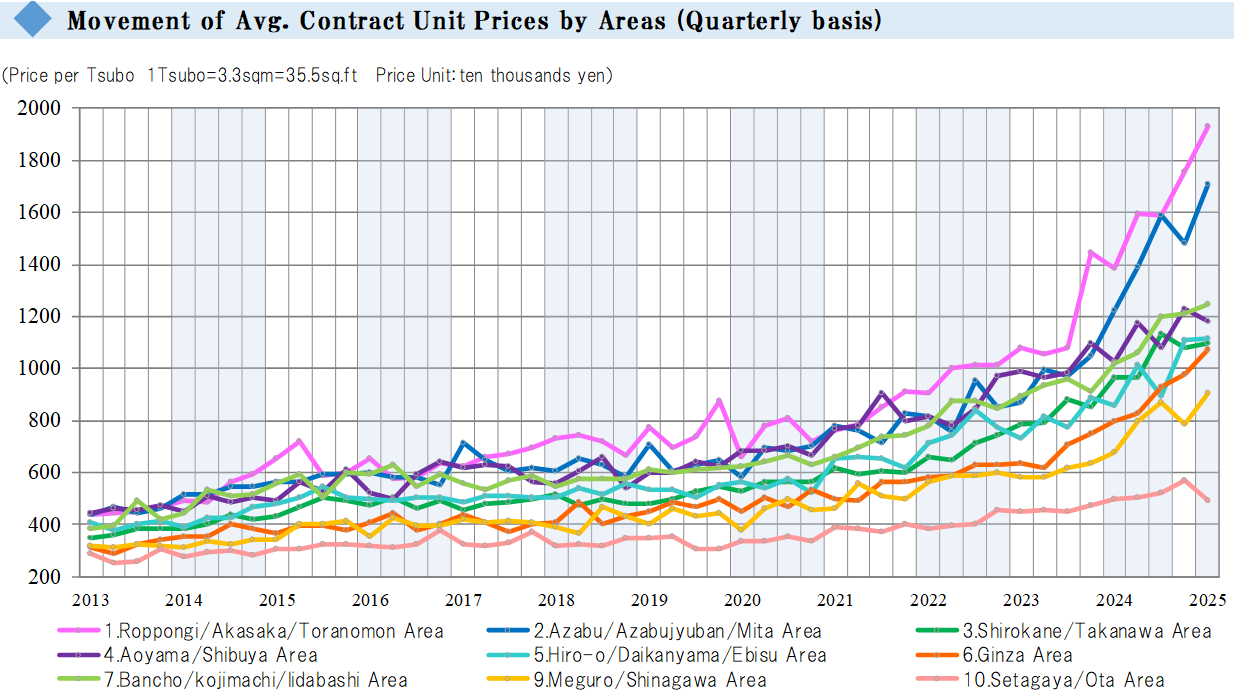

【Chart 2】

The chart above shows the trend in the average contract price per tsubo by area. While the average contract price decreased this quarter in the three areas of the "Aoyama / Shibuya Area," the "Meguro / Shinagawa Area," and the "Setagaya / Ota Area," it increased in seven other areas. In six of these seven areas, it reached a new record high since the beginning of data collection. Among these, the average contract price reached a new record high for the seventh consecutive quarter in the "Ginza Area," the fifth consecutive quarter in the "Bancho / Kojimachi / Iidabashi Area," and the second consecutive quarter in the "Roppongi / Akasaka / Toranomon Area" and the "Hiroo / Daikanyama / Ebisu Area."

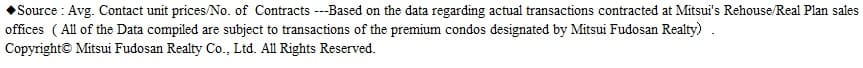

【Chart 3】

The chart above shows the percentage of purchases by overseas residents among Mitsui Fudosan Realty Group transactions and their average contract prices per tsubo (JPY and USD) compared to the exchange rates.

The percentage of purchases by overseas residents rose by +0.6 ppt QoQ in this quarter to 6.9%. The average price per tsubo in this quarter (converted to USD) was up sharply by $9,495 QoQ to $87,429. For the fourth consecutive quarter, this is the highest USD price per tsubo since the beginning of data collection, an indicator of the effect of the recent increase in the value of the yen in addition to rising yen prices per tsubo.

The number of contracts increased this quarter for the third consecutive quarter, and the average price per tsubo set a new record high for the eighth consecutive quarter. The inventory for all 10 areas combined as of the end of this quarter was 987, up QoQ for the fourth consecutive quarter by +21%. It will be worthwhile to note how this inventory will affect the number of contracts and the average price per tsubo in the ensuing quarters. It remains prudent to keep a close watch on the market impact of such factors as the state of reselling large-scale relatively newer properties along with trends in the Nikkei Average, exchange rates, the global situation, and inbound demand in the coming quarters.

お問い合わせ Contact us

まずは、お気軽にご相談ください。