Investment Real Estate Market Report | 1Q FY2025

Areas subject to collection of data

Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-ku, Katsushika-ku, and Adachi-ku

Yokohama / Kawasaki region: Yokohama city and Kawasaki city

Detailed descriptions

Pick Up Area: For investment real estate, trends in the average gross yields on contract price and initial asking price, together with the number of closed contracts by submarkets are represented in the graph. The details of the transition of actual market value and properties both for sale and sold in certain neighborhoods are also shown.

Market Overview: As an overview of all the submarkets, the trend from the past to this quarter is available. Trends in the average gross yields based on contract price and initial asking price together with the number of closed contracts by area are shown for comparison.

Data Source: Information is extracted from the database containing properties offered for sale and contracts concluded through Mitsui Fudosan Realty Network (En-bloc condominiums / office buildings / apartment buildings).

- Number of Transactions & Average Gross Yield on Contract Price: Number of contracts closed in a quarter (three months) and average gross yield of them (including estimated values)

- Average Gross Yield on Initial Asking Price: Quarterly average gross yield of closed contracts based on their asking price initially quoted

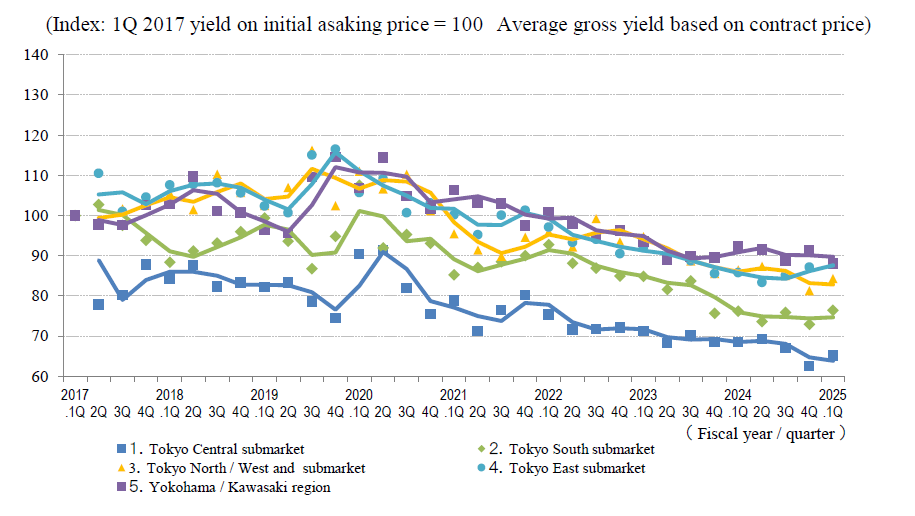

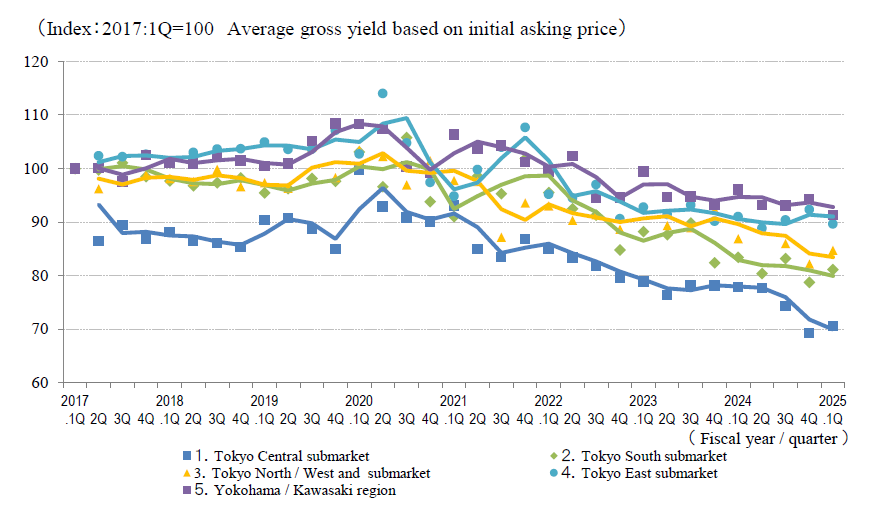

*Figures in each chart represent indices based on values for 1Q / FY2017 set at 100.

(Average Gross Yield on Contract Price is shown as an index to Average Gross Yield on Initial Asking Price for 1Q / FY 2017 set at 100.)

[Note] The historical data may be revised subsequently due to maintenance carried out from time to time, such as adding newly acquired data.

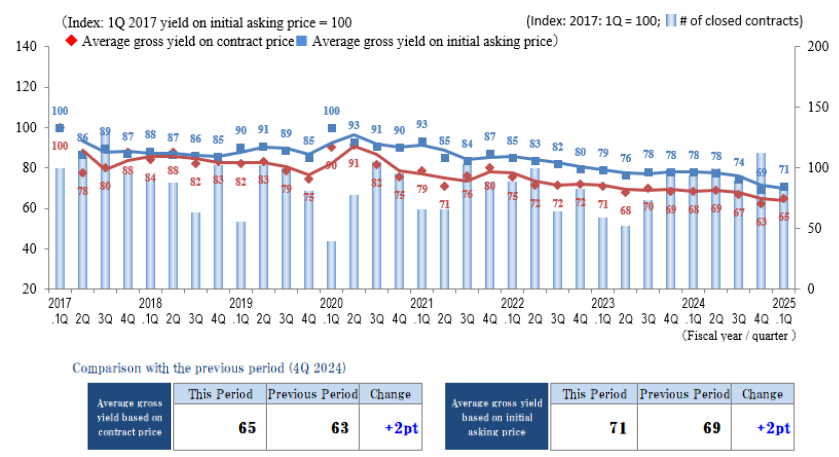

Pick Up Area -Tokyo Central submarket-

(*)Tokyo Central submarket: Minato-ku, Chiyoda-ku, Chuo-ku, Shibuya-ku, Shinjuku-ku, and Bunkyo-ku

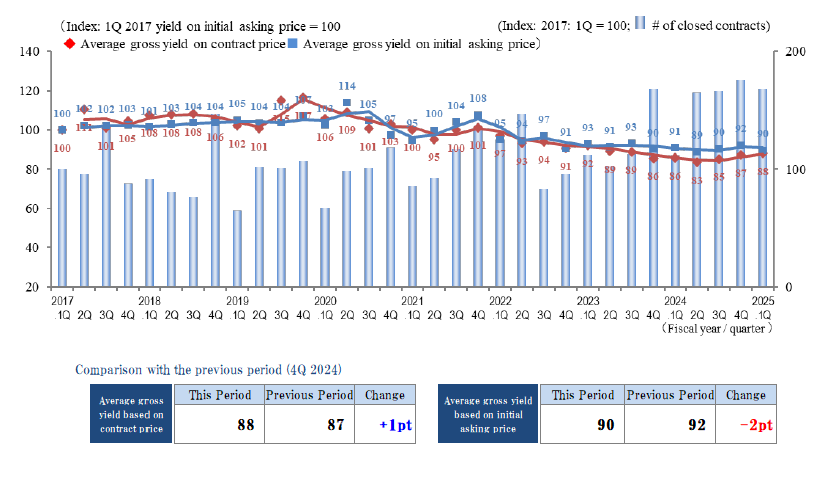

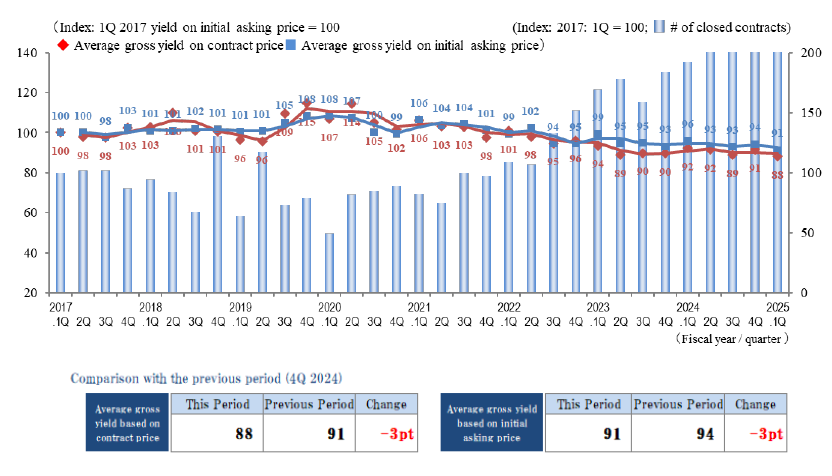

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The indices increased for the average gross yield on the initial asking price and on the contract price both showed a gentle increasing trend, rising by 2 pt, although the number of contracts was down slightly QoQ in the Tokyo central submarket in 1Q / FY 2025. The leasing market in the Tokyo central submarket is reviewed below:

■ Residences: The increasing trend in rents continued, centered on high-end properties (such as those with large floor areas and parking lot access).

■ Offices: The trends toward lower vacancy rates and higher rents continued for both new and existing supplies of large-scale office buildings amid booming demand from corporate relocations to better locations.

■ Retail: Although rents showed an increasing trend centered on street-level shops in well-known areas of the Tokyo central submarket, demand slowed slightly as opening of new stores by major brand groups ran its course.

The favorable conditions in the leasing market are having a positive effect on the investment real estate market. At the same time, there are growing concerns about the possible impact of continued rising interest rates as was experienced through the previous quarter, as well as realization of political uncertainty due to the second Trump administration and the results of the House of Councilors elections.

One major topic during the quarter is a succession of delays and revisions to redevelopment plans. While both of these are due to the past few years of rising construction costs, the severity of this issue is brought into relief by the fact that it has come to impact such prime sites as those in front of Nakano, Shinjuku, and Ikebukuro stations. While some observers expect existing properties to have increasing scarcity value as supply of new properties decreases, there also are concerns that uncertainty regarding redevelopment plans could put downward pressure on real estate prices in areas where land prices were rising out of expectations for redevelopment. Conditions will continue to require close observation.

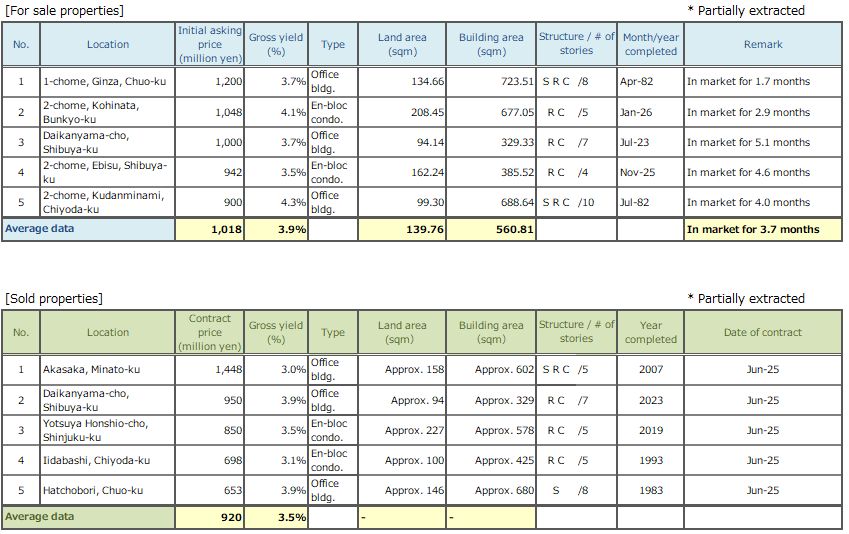

Pick Up Area -Tokyo South submarket-

(*) Tokyo South submarket: Shinagawa-ku, Meguro-ku, Setagaya-ku, and Ota-ku

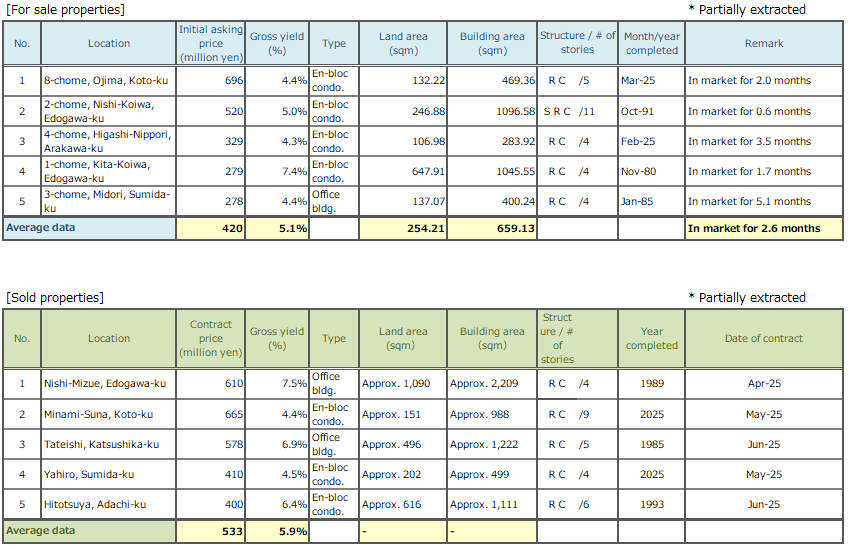

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The Indices of the average gross yield on the initial asking price and the contract price in the Tokyo south submarket both increased by 3 pt QoQ in 1Q / FY 2025 to 81 and 76, respectively. While each of these is trending up QoQ, the yield trend over the most recent year can be said to be largely flat.

Although the number of contracts made decreased QoQ, the extent of the decrease was limited. The number of contracts made remains roughly as high as it was in each quarter of the past year. Overall, market conditions appear to remain stable in the Tokyo south submarket.

From a look at the 23 wards of Tokyo as well, there are no major changes apparent in the investment real estate market, including the Tokyo south submarket. Inbound demand backed by favorable leasing market conditions in the greater Tokyo area and the low yen also are supporting favorable market conditions.

At the same time, high building material prices and a severe labor shortage pushing up construction costs remain major causes of concern, and the inflationary trend has grown even more pronounced. Gently rising interest rates from last year also could affect the real estate market. Moving forward, changing monetary policies and economic conditions in Japan and around the world could impact inbound demand, interest rates, prices, and investor confidence. Market conditions will continue to require close observation.

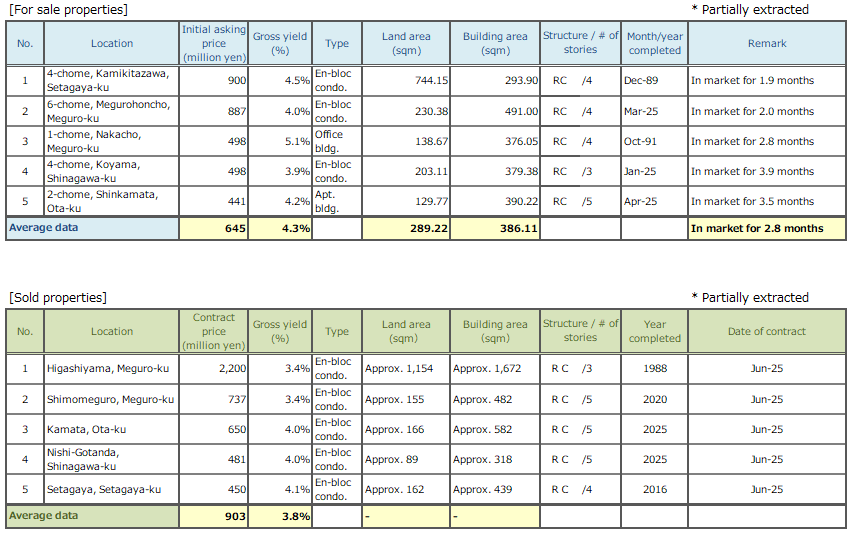

Pick Up Area -Tokyo North / West submarket-

(*) Tokyo North / West submarket: Suginami-ku, Nakano-ku, Nerima-ku, Toshima-ku, Itabashi-ku, Kita-ku, and Taito-ku

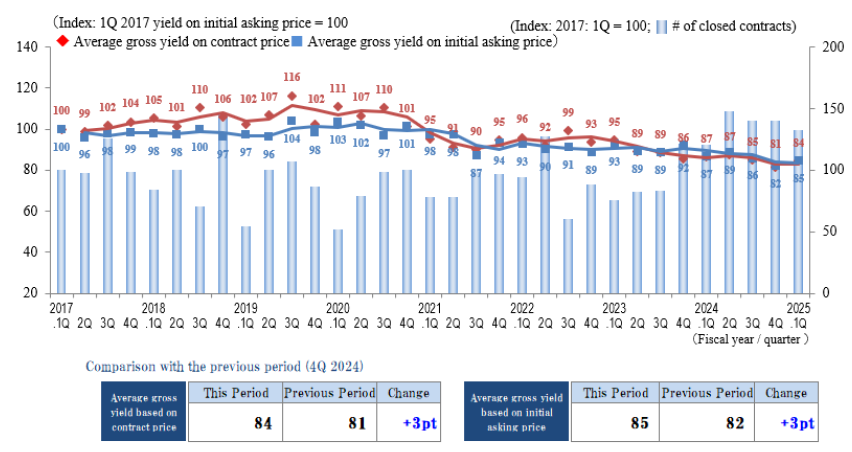

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

In the Tokyo north / west submarket in 1Q / FY 2025, although both the index of the average gross yield on the contract price and the index of the average gross yield on the initial asking price rose by 3 pt QoQ (property prices fell), the trend over the most recent year can be said to be largely flat. In the average year, the number of contracts made tends to decrease sharply in 1Q from 4Q in the previous year. This year's decrease, however, was minor, as active trading appears to continue.

While investor confidence in Japan has been affected by a variety of recent topics, such as countries' responses to US trade policies, military conflict in multiple countries and regions, and a domestic economy that has entered a world of positive interest rates, overall the investment real estate market was stable with no major volatility in 1Q / FY 2025.

In the July 20 ordinary House of Councilors elections, the Liberal Democratic Party and the Komeito Party were unable to keep the number of seats needed for a majority because of major losses, resulting in a minority government in the House of Councilors. While this does not appear to have had an immediate impact on the investment real estate market, future policies could lead to changes in inbound real estate demand, loan interest rates, policies on inflation, including building material prices, and market conditions. Accordingly, it can be considered important to continue to closely monitor and adapt to domestic and overseas political, economic, and financial trends.

Pick Up Area -Tokyo East submarket-

(*) Tokyo East submarket: Koto-ku, Sumida-ku, Arakawa-ku, Edogawa-Ku, Katsushika-ku, and Adachi-ku

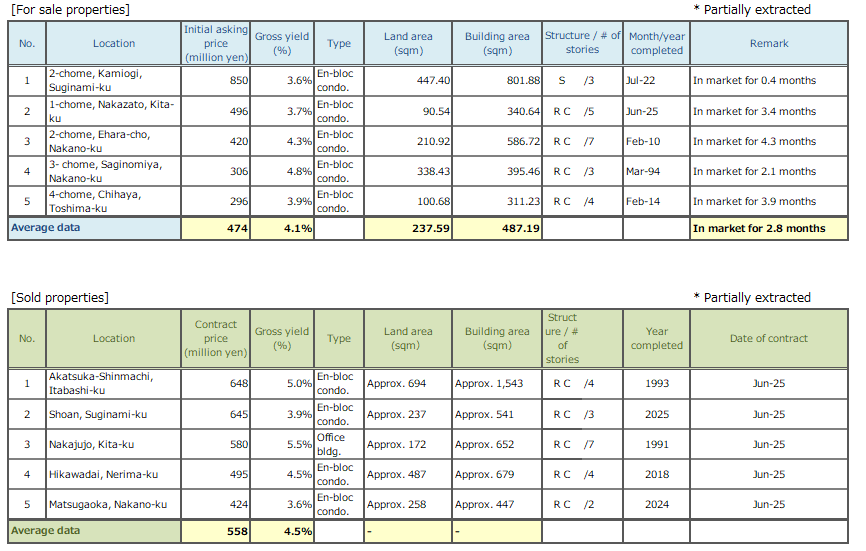

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The index of the average gross yield on the contract price was up 1 pt QoQ to 88 in the Tokyo east submarket in 1Q / FY 2025 as the increasing, though gentle, trend in this index continued (prices fell) since 2Q / FY 2024. The number of contracts has remained high since 2Q / FY 2024, a sign that active trading continues.

At the same time, a look at the details of individual transactions shows variation in the length of time from when a property comes on the market until a contract is concluded, and some major gaps have appeared between the initial asking price and the contract price as a result of large-scale price negotiations. Thus, the trend toward market polarization continues.

Also, as the inflationary trend in building material prices continues, among transactions intended for development, there are increasing cases of land prices being difficult to increase because of the effect of rising construction costs. This can be seen to be having a negative effect on purchase decision-making, leading to not a few cases of large-scale price negotiations as described above.

While no major changes are apparent in the market at this time, since uncertain conditions are expected to continue, there is a need to continue closely monitoring the market impacts of such external factors as interest rates, exchange rates, stock prices, and inflation.

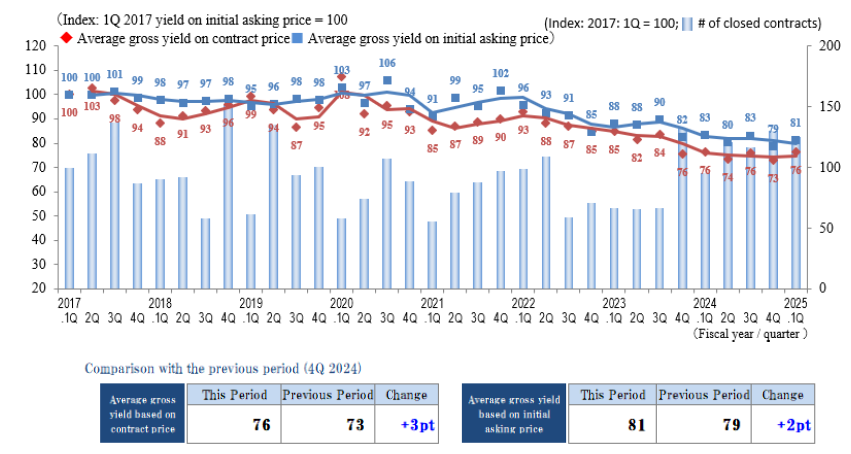

Pick Up Area -Yokohama / Kawasaki region-

(*) Yokohama and Kawasaki region: Yokohama city, Kawasaki city

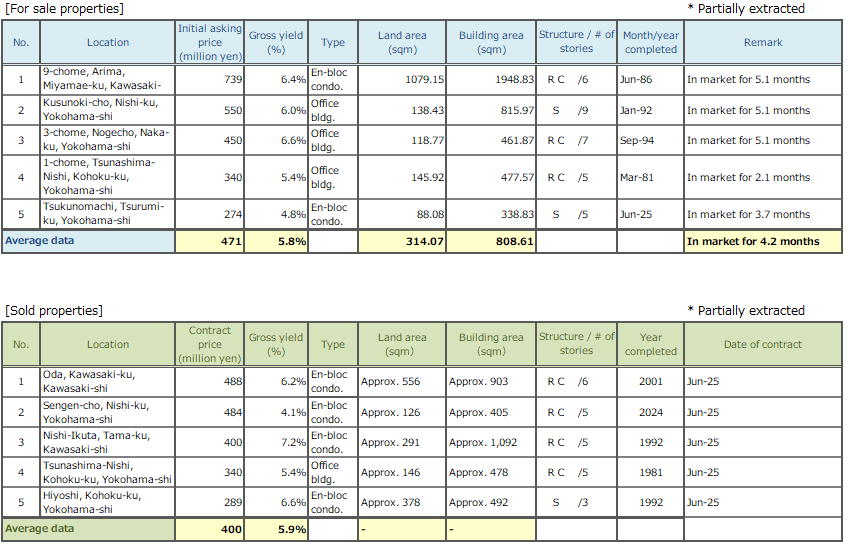

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions

◆Brokered Transactions of Investment Real Estate in the Submarket

The indices of the average gross yield on the contract price and the initial asking price both fell (prices rose) in the Yokohama / Kawasaki region in 1Q / FY 2025 to reach new record low levels since data collection began in 2017. The number of contracts made in the region decreased only slightly for the third consecutive quarter since 2Q / FY 2024 since the number of transactions remains high and lively market conditions can be said to continue.

While it is thought that a certain number of customers would consider the Yokohama / Kawasaki region, which is lower grossing than the Tokyo central submarket and where high yields can be expected, a pronounced polarization trend remains apparent between central and suburban districts, and investors can be expected to become even more selective as the investment real estate market heats up.

Despite the upward trend in rent, even higher increases in construction costs have led to continued cases being apparent of pressure on developers' business bottom lines. The price trend is bearish, particularly on small commercial sites which involve higher construction cost ratios.

Uncertain conditions continue amid numerous factors that could lead to major changes in economic conditions, such as US tariff policies and Japanese elections. Changing monetary policies and economic conditions in Japan and around the world, including exchange rates and stock prices, will require closer observation moving forward.

General overview

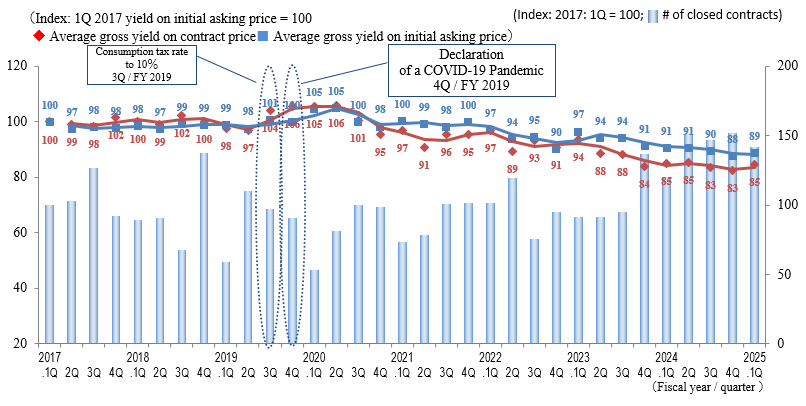

◆Movements by Quarter: Average Gross Yield on Contract Price / Average Gross Yield on Initial Asking Price / Number of Transactions for the 5 Areas

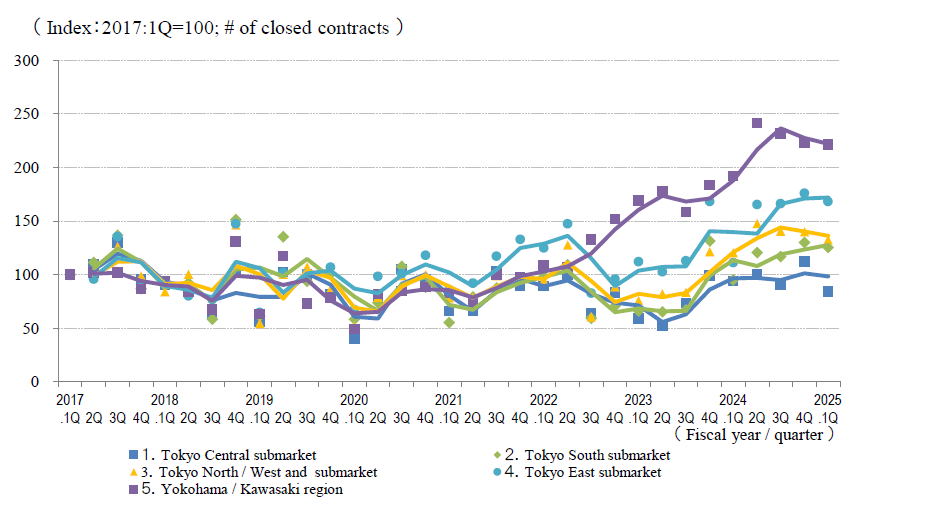

◆Movements in Number of Transactions by Area

◆Movements in Average Gross Yield on Contract Price by Area

◆Movements in Average Gross Yield on Initial Asking Price by Area

The average gross yield on the contract price is up QoQ in 1Q / FY 2025 in each region other than Yokohama and Kawasaki because the total index for the region as a whole increased by 2 pt. While the trend in the average gross yield on the initial asking price varies by region, the total index for the region as a whole increased by 2 pt QoQ.

While the total number of contracts made for the region as a whole was down QoQ, it remained high in comparison to 1Q in previous fiscal years as active trading appears to continue across the region.

At the same time, as noted in the comments on each region there is increasing concern about such external factors as rising construction costs, interest-rate fluctuations, and political uncertainty (such as the return of the Trump administration and the House of Councilors election results). Under such circumstances, it is essential to draft and execute strategies based on more carefully identifying market trends.

お問い合わせ Contact us

まずは、お気軽にご相談ください。