PROPERTY MARKET TRENDS | 2Q 2024

PROPERTY MARKET TRENDS | 2Q 2024

Concerns about the effects on the market of rising construction, labor, and other costs

Residential: The condominium market slowed down due to price increases, while the rental apartment market is favorable

Office: Stable demand as workers return from remote work to office work

Shopping centers: Favorable conditions continue for department stores as inbound demand remains high

TEXT: Yoko Fujinami, ib Research & Consulting Inc.

Toru Kawana, Industrial Marketing Consultants Co., Ltd.

Residential

The supply of condominiums in the Tokyo metropolitan area is decreasing as is the contract rate in the first month of sales. As a result, rents are rising due to scarcity and the condominium market is attracting attention.

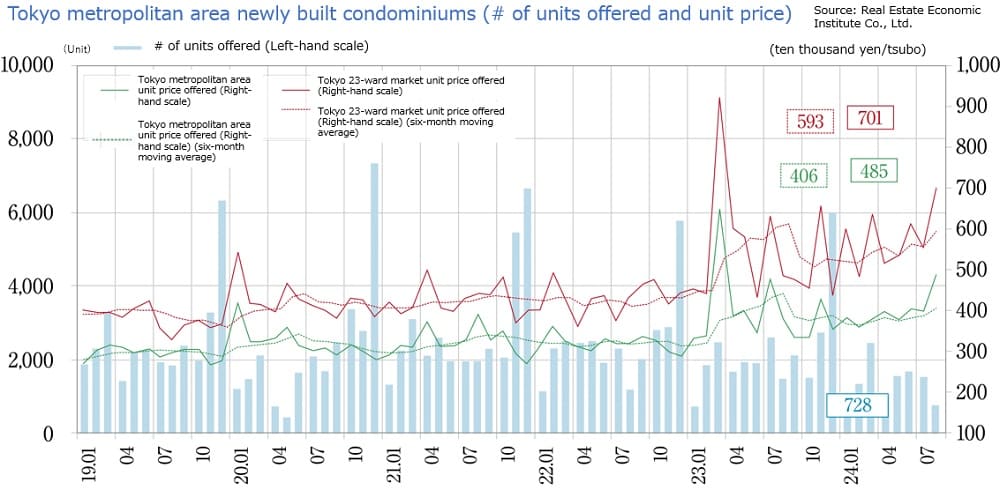

■ Newly built condominiums sales in the Tokyo metropolitan area

・In September 2024, there was a new supply of 1,830 units (down 13.7% from 2,120 units in the same month last year), and the average initial sales price, condominium unit size, and price per tsubo were JPY 77.39 million, 67.43 sqm, and JPY 3.795 million per tsubo, respectively. Since the annual average price per tsubo in 2023 was JPY 4.053 million per tsubo, prices show a downward trend. The month-end inventory was 5,025 units, and the contract rate in the first month of sales was 65.5%, up 2.0 ppt MoM and down 2.2 ppt YoY. Slow conditions continue since, during January-September, the contract rate in the first month of sales was 70% or higher in only January, March, and July.

・The 23 wards of Tokyo accounted for a 33.6% share of the supply by area, down from the 2023 annual average of 44.3%. The cumulative supply in January-September was 13,120 units. Compared to the annual supply of 26,873 in 2023, the supply in the first nine months was down by more than half.

■Newly built condominiums sales in the Kinki region

・In September 2024, there was new supply of 1,280 units (down 8.1% from 1,393 units in the same month last year), and the average initial sales price, condominium unit size, and price per tsubo were JPY 58.41 million, 59.47 sqm, and JPY 3.246 million per tsubo, respectively. The contract rate in the first month of sales was 80.8%, up 8.6 ppt MoM and 0.3 ppt YoY, showing favorable conditions.

・The city of Osaka accounted for a 37.4% share of supply by area, down from the 2023 annual average of 42.4%. The cumulative supply in January-September was 9,846 units. The supply in the first nine months reached about 60% of the annual supply of 15,385 in 2023.

■Second-hand condominiums sales in the Tokyo metropolitan area

・The number of contracts made in September 2024 was 3,047, down 4.5% YoY. The average building age of contracted units was 24.87 years, while sold price, condominium unit size, price per tsubo were JPY 48.61 million (up 5.3% YoY), 64.09 sqm (up 0.5% YoY), and JPY 2.508 million per tsubo (up 4.7% YoY), respectively. The price per tsubo recorded the 53rd consecutive month of increases on a YoY basis. The number of units newly listed and in inventory were 16,195 units (down 4.8% YoY) and 45,403 (down 1.9% YoY), as inventories fell for the fifth consecutive month on a YoY basis.

・A look at the numbers of contracts made and sold price per tsubo, respectively, by area shows respective changes of -11.7% and +11.2% in the Tokyo 23 wards, -15.0% and +7.4% in suburban Tokyo, +2.2% and -0.8% in Kanagawa Prefecture, -4.1% and +7.4% in Saitama Prefecture, and +19.9% and +5.4% in Chiba Prefecture as sales prospects were uncertain because of rising prices across the entire Tokyo metropolitan area.

■Rental apartments in the Tokyo metropolitan area

・The number of contracts made in July-September 2024 was 30,328 with the Tokyo 23 wards accounting for 62.8% of these contracts. This was a slight increase from 29,653 contracts in total made in the last period (April-June).

・Average (monthly) rent by area was JPY 115,000 in the Tokyo 23 wards, JPY 79,000 in suburban Tokyo, JPY 88,000 in Yokohama and Kawasaki, JPY 77,000 in Saitama Prefecture, JPY 79,000 in Chiba Prefecture, and JPY 71,000 in suburban Kanagawa Prefecture. Condominium unit size averaged 32-33 sqm in the Tokyo 23 wards, Yokohama, and Kawasaki and in the upper 30 sqm range in other areas.

■Market overview

・The market for newly built condominiums was down as the share of supply in the Tokyo 23 wards, where the listing price levels are high, decreased. Average listing prices in the Tokyo 23 wards in January-September were JPY 110.65 million, or JPY 5.696 million/tsubo, substantially higher than the averages for the Tokyo metropolitan area other than the Tokyo 23 wards, which were JPY 57.48 million, or JPY 2.87 million/tsubo. The average prices of family units for first-time buyers are JPY 50 million or more because of higher land prices and construction costs. In addition, factors, such as concerns about rising interest rates and higher prices, had a dampening effect on buyers' mindsets as some properties apparently were slow to sell in areas other than the Tokyo 23 wards.

・The contract rate in the first month of sales on newly built condominiums over the past six months (April-September) was in the 50% range once, in the 60% range four times, and at 70% or higher once in the Tokyo metropolitan area, while in the Kinki region, it was in the 60% range twice, in the 70% range twice, and in the 80% range twice as contractual conditions in the Kinki region surpassed those of the Tokyo metropolitan area. The rate has remained at 80% or higher since May in the city of Osaka in particular as sales conditions are favorable in that city.

・The second-hand condominium market had showed increases in both the numbers of units listed and numbers of contracts as the supply of newly built condominiums decreased and their prices rose. However, as prices have risen since summer units listed, stock, and contracts have decreased slightly as demand seems to have leveled off.

・The Tokyo 23 wards account for about 60% of the rental apartment market, in which contracts were made on about 10,000 units per month. In addition to increasing numbers of residents choosing central city locations for commuting and living convenience, demand is growing centered on the younger generation as condominium prices rise. This has led to a chronic shortage. Amid rising market prices, the high profitability level is attracting business operators' attention.

Data: As for new supply = Real Estate Economic Institute Co., Ltd., and as for secondary market = Real Estate Information Network for East Japan

Office

As rents rise in each major city, newly completed office buildings have continued to show high vacancy rates since the second half of 2024. Numerous new buildings are planned for completion in the future, but it will take time for vacancies to be filled due to intensified competition.

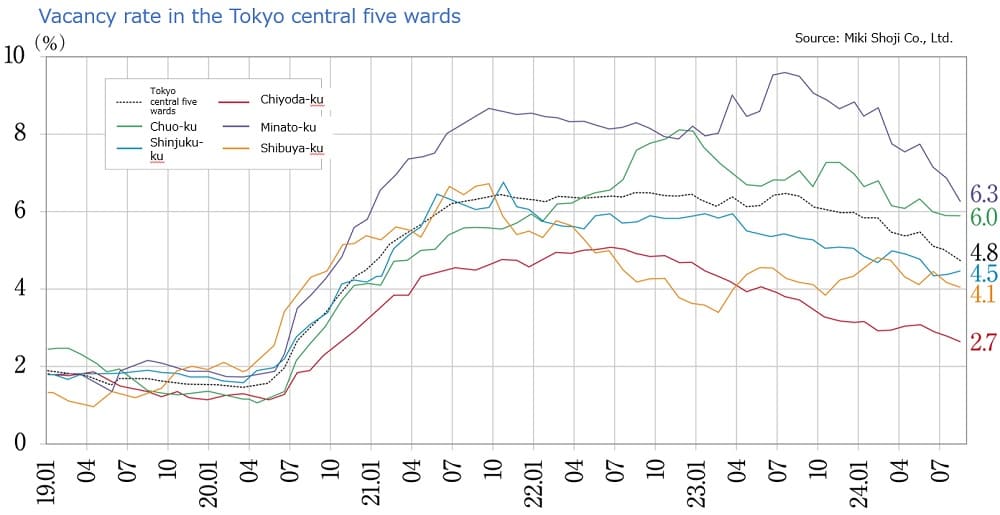

■Large-scale office buildings in Tokyo CBD (Central 5 Wards)

・As of September 2024 the vacancy rate was 4.61%, down 0.15 ppt MoM and remaining below 5% since August 2024 favorably.

・Average rent was JPY 20,126/tsubo, up JPY 23 MoM and up JPY 376 YoY as rent has remained above JPY 20,000/tsubo since July 2024.

・Total leased floor area in September was 8,040,943 tsubo, up 25,577 tsubo since January, as eight new office buildings came on the market.

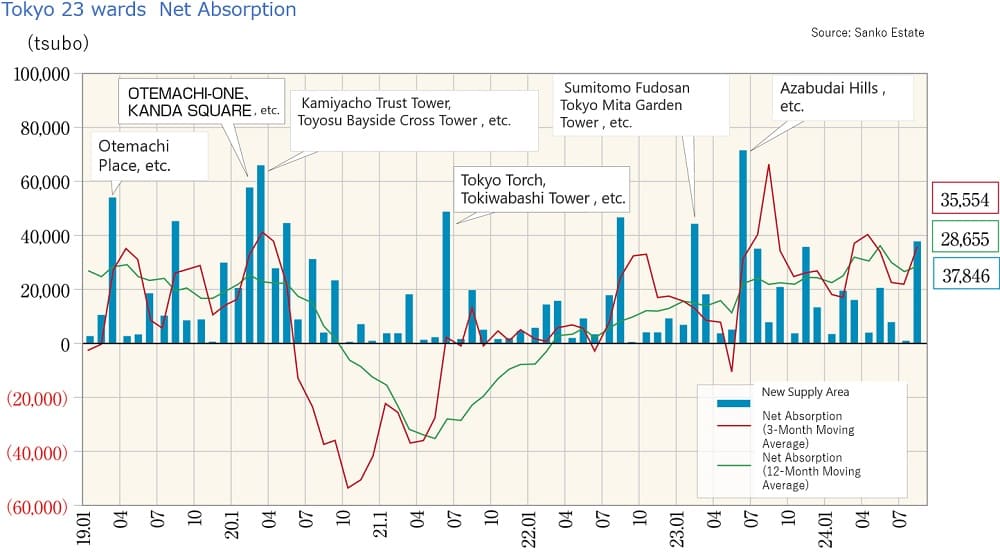

■Net absorption

・Single-month net absorption (change in office occupied floor space) in August was +58,778 tsubo, remaining positive for the seventh consecutive month and up 25,374 tsubo YoY. The cumulative figure for January-August was 243,232 tsubo since occupied floor space was up sharply on track from the cumulative figure of 196,151 tsubo in the same period of 2023.

・Full-year new supply of office space in 2024 is projected to be about 90,000 tsubo. Demand of about 110,000 tsubo is projected because of increased hiring, business expansion, and other moves by tenants, chiefly businesses experiencing favorable performance. Thus, the market is expected to remain in positive territory.

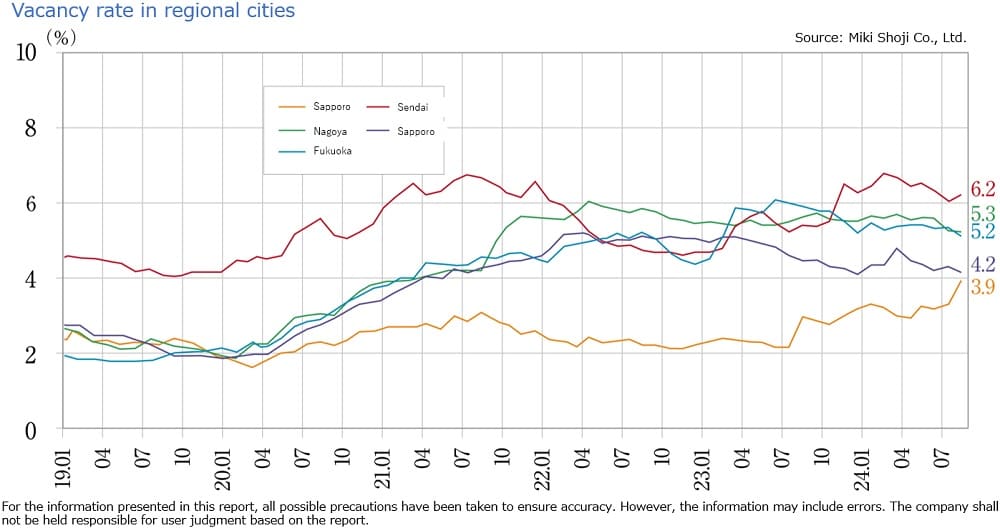

■Vacancy rates, and movements in average rents in major regional cities / September 2024

・Sapporo: Vacancy @ 4.08% up 0.16 ppt MoM. Average rent @ JPY 10,604 per tsubo up JPY 25 MoM. (Vacancy rate changed little, while average rent improved.)

・Sendai: Vacancy @ 6.16% down 0.06 ppt MoM. Average rent @ JPY 9,379 per tsubo up JPY 2 MoM. (Vacancy rate and average rent changed little.)

・Yokohama: Vacancy @ 7.80% up 0.12 ppt MoM. Average rent @ JPY 12,864 per tsubo up JPY 1 MoM. (Vacancy rate and average rent changed little.)

・Nagoya: Vacancy @ 5.04% down 0.21 ppt MoM. Average rent @ JPY 12,531 per tsubo up JPY 34 MoM. (Vacancy rate improved slightly, while average rent improved.)

・Osaka: Vacancy @ 4.29% up 0.10 ppt MoM. Average rent @ JPY 12,132 per tsubo down JPY 4 MoM. (Vacancy rate changed little, while average rent worsened slightly.)

・Fukuoka: Vacancy @ 5.14% down 0.01 ppt MoM. Average rent @ JPY 11,769 per tsubo up JPY 26 MoM. (Vacancy rate changed little, while average rent improved.)

The vacancy rate is on an improving or unchanging trend MoM in all areas. The average rent increased in the above areas other than Osaka.

■Status quo and future market outlook

・The percentage of workers working in the office appears to have recovered largely to its pre-COVID level. Rates of remote working have fallen sharply at most employers, and the pronounced return to work styles based on office work has led to increases in relocations to large spaces.

・Vacancy rates are low both in Tokyo business districts (2-6%) and in provincial cities (4-7%). At the same time, vacancy rates on new properties remained high at 49.4% in Sapporo, 43.3% in Sendai, 22.0% in Tokyo, 62.0% in Yokohama, 30.7% in Nagoya, 26.2% in Osaka, and 41.6% in Fukuoka.

・While tenants continue to seek more comfortable working environments, such as free-address desks, the advantages of traditional desk assignments, which foster communication among employees, appear to be recognized anew.

・Planned new supplies of office buildings in 2024 are for 28 buildings (232,000 tsubo) in Tokyo business districts and nine buildings (232,000 tsubo) in Osaka business districts. In the Osaka market, numbers of buildings and total floor space are up sharply from 2023, and supply is projected to be at its highest level since 1990. While the market shows a recovering trend, attention is focusing on how much demand will be captured by new office buildings.

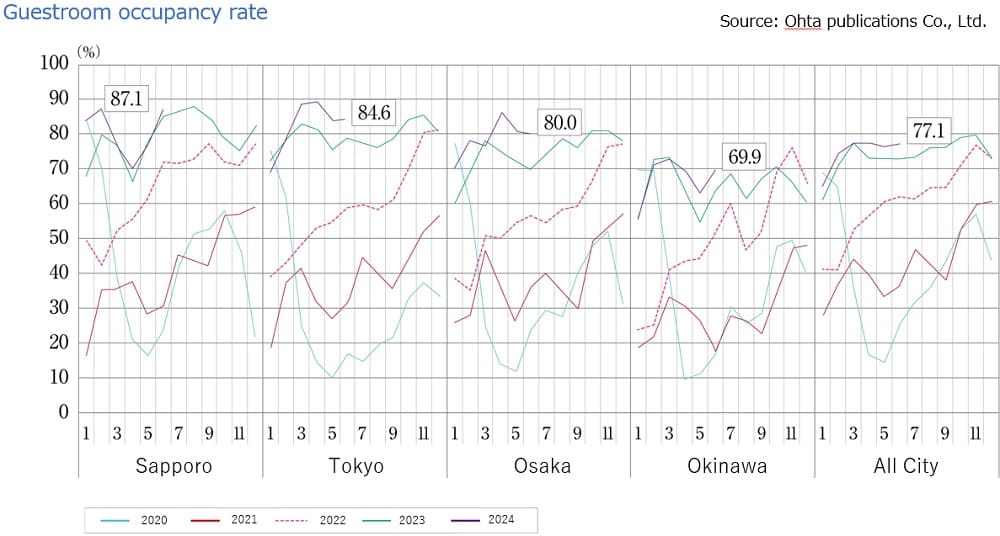

Hotels

The number of visitors to Japan from overseas is expected to reach a new record high on an annual basis. However, it is mainly urban areas in the Tokyo metropolitan area and the Kinki region that are benefiting, and there is a pressing need to attract visitors to the provincial regions.

■Numbers of overnight stays are increasing with rapid growth in inbound tourism

・In August 2024, the total number of overnight stays in Japan was 66.11 million (up by 2.7% YoY). Of these, 12.81 million stays were by visitors from abroad (up 20.9% YoY), and 53.3 million were by Japanese guests (down 0.8% YoY), which represents a significantly increased demand for overnight accommodation mainly from inbound tourists.

■Recent trends by category

・A look at occupancy rates by type of facility in August 2024 shows rates of 63.7% for resort hotels, 74.8% for limited-service hotels, and 72.3% for full-service hotels. The growth in guests has had some negative effects as well, such as rising accommodation charges or the inability to secure reservations because of overdemand in popular areas, such as Kyoto.

■Inbound trends

・A look at the total number of overnight stays by visitors from overseas in August 2024 shows that the top countries and regions were China (2.855 million), Taiwan (1.541 million), South Korea (1.329 million), and the United States (801,000). The rebound in tourism from China is driving growth in inbound tourism.

・Even as Japanese cultural and other experiences account for a rising share of inbound consumption, they tend to be centered on urban areas. Dispersion of inbound demand to provincial areas will be an issue for the future.

■Status quo and future market outlook

・In addition to growth in inbound guests, domestic travel by Japanese travelers is also heating up, and hotel demand is expected to continue to increase. Already, IHG, Hilton, Hyatt, Marriott, Hoshino Resorts, and others are focusing on new hotel development, and favorable conditions continue.

・A hotel shortage and rising room rates are being manifested in urban areas. The market is expected to focus on measures to attract inbound travelers to provincial regions and the development of tourist attractions and activities in the future.

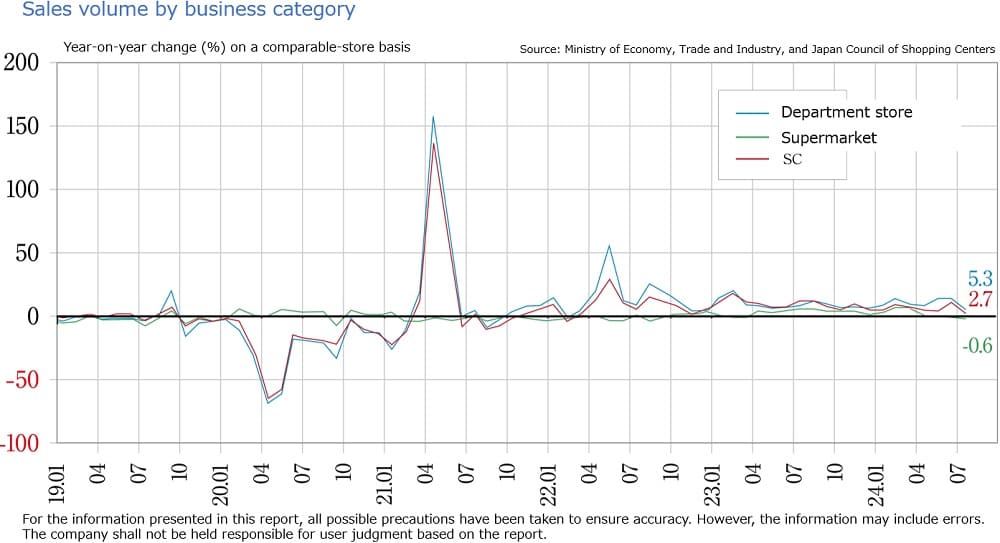

Commercial

Industry reorganization is accelerating as the GMS Ito-Yokado has announced large-scale store closures while fierce summer heat and growing inbound demand push sales higher.

■Sales volume and status quo of shopping centers

・Existing store sales for shopping centers (overall) were approximately JPY 612.07 billion (up +7.1% YoY) in August 2024 because of the increased number of shoppers due to seasonal factors, such as summer holidays and summer festivals.

・A survey of inbound consumption trends announced by the Japan Tourism Agency showed that inbound spending on shopping more than doubled from JPY 315.2 billion in April-June 2023 to JPY 646.6 billion in 2024. Chinese visitors spent the most on shopping at JPY 206.4 billion.

・Seven & i Holdings has announced new management strategies of enhancing its convenience-store business and restructuring its business portfolio, moving away from the Ito-Yokado business. It plans to close 10 stores or more during the year.

・The number of new shopping centers opening in January-November 2024 was 32, of which 11 were in the Tokyo metropolitan area, five in the Kinki region, five in Kyushu/Okinawa, and 11 in other regions. Most of these opened in areas with high population densities. Development of stores with roots in their local communities is progressing in Aomori, Akita, and Iwate prefectures.

■Future market outlook

・Record heat in 2024 led to strong sales of summer wear in addition to shoppers visiting shopping centers to get out of the heat. Despite expectations for sales of products related to events, such as Halloween and Christmas in the winter season, there are concerns that inflation since autumn could dampen personal consumption. Strategies to attract shoppers, such as holding events inside shopping centers, will be important for overcoming the negative effects on consumer confidence.

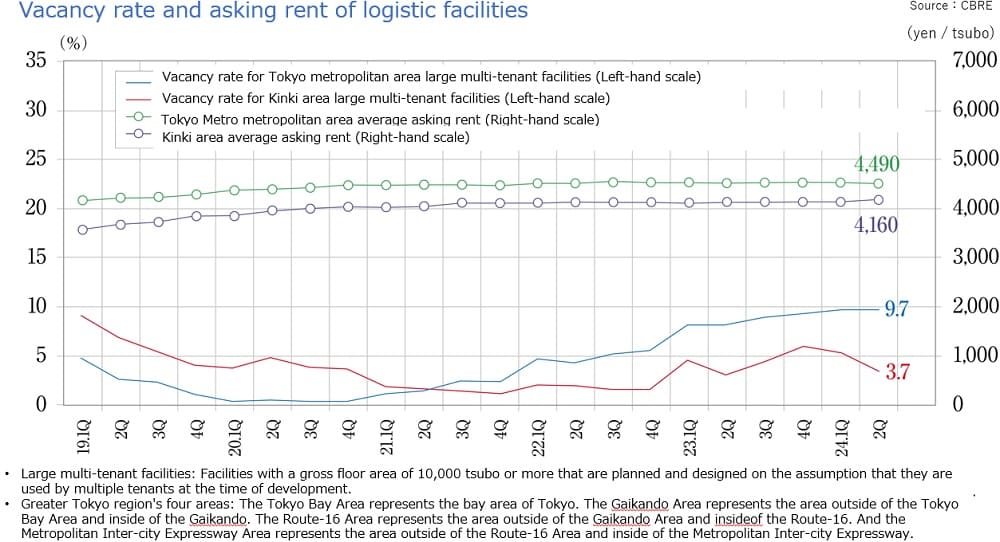

Logistics

New supply is in a decreasing trend, and vacancy rates are falling. Rents can be expected to rise in the Tokyo Bay area and the Tokyo Gaikan Expressway area, where demand is strong.

■Market conditions in the Tokyo metropolitan area and conditions by area

・In the Tokyo Bay area, the vacancy rate was 10.4% (down 1.0 ppt YoY), and effective rent was JPY 7,630 per tsubo (flat). Because of the small numbers of vacant and new properties, rents are expected to increase in the future.

・In the Tokyo Gaikan Expressway area, the vacancy rate was 5.9% (up 1.5 ppt YoY), and rent was JPY 5,190 per tsubo (flat). The vacancy rate is expected to improve because of the small numbers of vacancies. While there is a possibility that rents could decrease on properties that have remained vacant for lengthy periods, overall, they show an increasing trend.

・In the National Route 16 area, the vacancy rate was 9.1% (down 0.5 ppt YoY), and rent was JPY 4,510 per tsubo (down 0.2% YoY). Filling of vacancies in large-scale properties is processing smoothly, for both new and existing properties. The vacancy rate is expected to improve because of the decrease in the new supply. Rents are bearish in Chiba and Kanagawa prefectures.

・In the Metropolitan Intercity Expressway area, the vacancy rate was 14.3% (up 0.6 ppt YoY), and rent was JPY 3,580 per tsubo (up 0.3% YoY). The demand level is recognized to be 84,000 tsubo for both new and existing properties, and numerous new large-scale properties are planned to come on the market, so vacancies are expected to rise. While rents showed an increasing trend due to supply growth in the Tama area, they are thought to be turning downward.

■Market condition in other regions

・Kinki region: The vacancy rate was 3.7% (down 1.6 ppt YoY) and effective rent was JPY 4,160 per tsubo (flat). The one new building completed is operating at full capacity, and vacancies are being filled in existing properties as well, resulting in a sharp improvement in the vacancy rate. Favorable conditions are expected to continue as leasing activities progress steadily for both properties planned for completion during the year and those planned for completion in the next period. An increase in new high-spec properties is expected to drive rents higher.

・Chubu region: The vacancy rate was 14.6% (down 1.9 ppt YoY) and effective rent was JPY 3,640 per tsubo (up 0.3% YoY). The one new building completed is operating at full capacity, and vacancies are being filled in existing properties as well, resulting in a decrease in the vacancy rate. Amid favorable demand centered on logistics firms, leasing activities are progressing steadily for planned properties. Since no next new large-scale properties are planned to come on the market until one year from now, the vacancy rate is expected to remain low and rent levels to increase until then.

・Fukuoka region: The vacancy rate was 3.2% (down 1.7 ppt YoY), and the effective rent was JPY 3,490 per tsubo (up 0.6% YoY). The one new building completed is operating at full capacity, and existing vacancies are being filled as well, amid favorable market conditions. Since only one new property is planned to come on the market during this year, the downward trend in the vacancy rate is expected to continue. Rent levels have risen in six consecutive quarters, and the increasing trend is expected to continue.

■Future market outlook

・New supplies of space projected in 3Q 2024 through 2Q 2025 are approximately 550,000 tsubo in the Tokyo metropolitan area, 350,000 tsubo in the Kinki region, slightly less than 120,000 tsubo in the Chubu region, and slightly less than 40,000 tsubo in the Fukuoka region, respectively. Since these are lower than past levels, vacancy rates appear to be decreasing, and rent levels shifting toward a gentle increase overall.

・It appears likely to take some time for conditions to improve in the National Route 16 area and the Metropolitan Intercity Expressway area because of the oversupply. Current favorable conditions are expected to continue in the Tokyo Bay area and the Tokyo Gaikan Expressway area, where demand exceeds vacancies. Rents are expected to increase in the Tokyo Bay area and the Tokyo Gaikan Expressway area and decrease in the National Route 16 area and the Metropolitan Intercity Expressway area.

・Favorable conditions prevail overall in the Kinki, Chubu, and Fukuoka areas, despite temporary increases in vacancy rates due to completion of multiple new properties over the past year. Few new properties are planned for the future, and vacancy rates can be expected to decrease as the stock of vacancies decreases.

・Demand exceeds supply in other markets (Sapporo, Sendai) as well. Sapporo enjoys logistics demand related to Rapidus, and active logistics demand is apparent in Sendai, too.

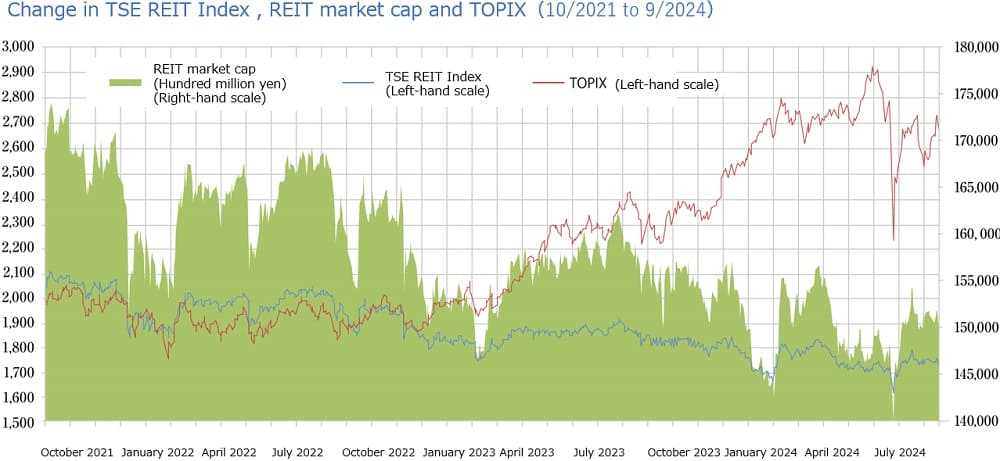

J-Reit

In light of lively inbound tourism, hotel REITs are attracting increased investment, and the movement toward REITs using surplus funds to purchase their own investment units is accelerating.

■J-Reit market trend

・At the end of September 2024, the TSE REIT index was 1,726.24, up slightly by 0.13% from the end of June, and market capitalization of all J-REITs was JPY 14.9208 trillion, up slightly by 1.01% from the end of June. During the same period, TOPIX was bearish, down by 5.83%, and fell sharply in early August due to low US stock prices and the rising yen. The TSE REIT index remained stable, however.

・Assets under management by all REITs rose by JPY 266.2 billion from the end of June to JPY 23.4281 trillion at the end of September. Hotel REITs were up JPY 230.5 billion, making up 86.7% of the increase. Inbound tourism has recovered sharply since COVID-19, backed by the low value of the yen on international currently markets since last year. Hotel demand is booming. There is a movement toward portfolio restructuring because some hotel REITs are raising funds through public offerings to invest in major resort hotels, while REITs are resuming investment in hotels after shifting toward residential and other assets that promised stable earnings during COVID-19.

・Seven REITs announced POs in 3Q (July-September), up from three in 2Q (April-June). While it has been difficult to conduct POs under conditions in which the market for investment units was bearish for a lengthy period, and investment unit prices were lower than NAV, REITs are achieving external growth while paying attention to interest-bearing debt amid expectations of higher interest rates by acquiring highly profitable hotels and residential properties with stable earnings.

■Status quo and future market outlook

・Under conditions in which it is difficult to increase funds, there is an accelerating trend toward REITs using surplus funds to purchase their own investment units instead of relying on external growth. Five REITs announced such moves in 3Q, and numerous REITs have done so since October as well. Some REITs have announced new indicators of capital efficiency and policies of continually acquiring their own investment units when the difference between their prices and NAV is at or above a certain level. Their attitude appears to be shifting more toward the capital markets.

・The trend toward reorganization is accelerating among logistics REITs. Mitsui Fudosan Logistics Park Inc., managed by Mitsui Fudosan, and Advance Logistics Investment Corporation, managed by the Itochu Group, have announced plans to merge in November, while plans have been announced for the US investment firm Ares Management to take over as the effective sponsor of GLP J-REIT. The rent market is bearish because of the oversupply of logistic facilities, and sponsors need to come up with new strategies.

お問い合わせ Contact us

まずは、お気軽にご相談ください。