PROPERTY MARKET TRENDS | 1Q 2024

PROPERTY MARKET TRENDS | 1Q 2024

Policies aiming for continuity are vital amid rapid market growth

Offices: The office market is improving as demand recovers, vacancy rates fall, and rents rise

Shopping centers: Market conditions have rebounded to higher than pre-COVID levels thanks in part to inbound demand

Logistics: While the Tokyo metropolitan area tends toward oversupply, new development is proceeding in the Kinki, Chubu, and Fukuoka regions due to excessive demand

TEXT: Yoko Fujinami, ib Research & Consulting Inc.

Toru Kawana, Industrial Marketing Consultants Co., Ltd.

Residential

As the supply of newly built condominiums continues to decrease and prices continue to rise in both the Tokyo metropolitan area and the Kinki region, demand is growing for second-hand condominiums and rental apartments as well, and the market is lively overall.

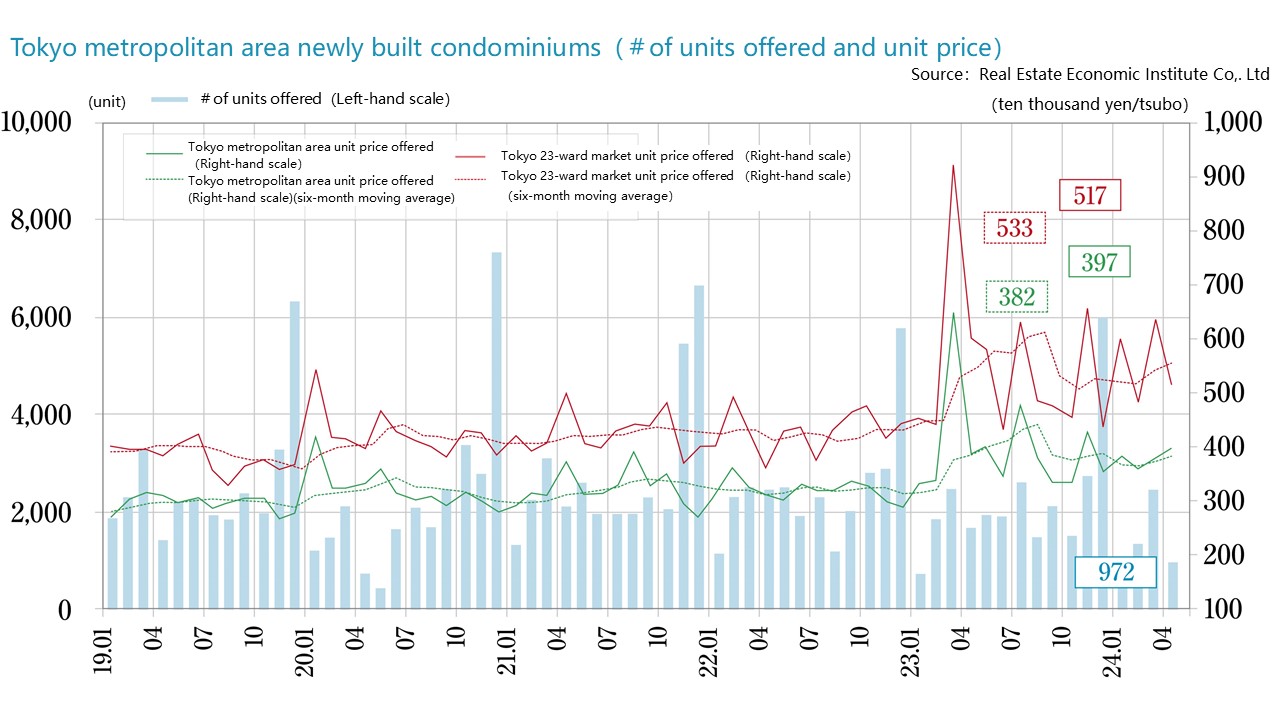

■ Newly built condominiums in the Tokyo metropolitan area

・In May 2024, there was a new supply of 1,550 units, and the average initial sales price, floor area, and unit price were JPY 74.86 million, 65.64 sqm, and JPY 3.763 million per tsubo, respectively. The pace of supply has slowed to a cumulative total of 7,404 units in the January–May period, which is only 27.5% of the annual supply of 26,886 units in 2023. The month-end inventory was 5,459 units, while the contract rate in the first month of sales was 56.0% down 6.4 ppt MoM and down 18.3 ppt YoY. The newly built condominium’s market share of the Tokyo 23 wards was only 36.8%, down from the 2023 annual average of 44.3%. This can be the factor that have driven down market conditions.

・Both prices and prices per tsubo have reached record highs in 2023 as reported by media but in 2024, the market appears to have somewhat settled down overall.

■ Newly built condominiums in the Kinki region

・In May 2024, there was a new supply of 1,051 units, and the average initial sales price, floor area, and unit price were JPY 57.50 million, 67.09 sqm, and JPY 2.828 million per tsubo, respectively. The month-end inventory was 2,696 units, while the contract rate in the first month of sales was 68.7%, up 0.2 ppt MoM and up 7.7 ppt YoY. Performance remains favorable at the mid-60% level or higher.

・The newly built condominium’s market share in Osaka and Kyoto prefectures rose, while those of the city of Osaka, Hyogo Prefecture, and other areas fell. Market conditions were favorable overall, with strong performance among properties with unit prices of more than 3 million yen/tsubo.

■ Second-hand condo sales in the Tokyo metropolitan area

・The number of contracts made in May 2024 was up +3.9% YoY to 2,845 units, rising for the 12th consecutive month. The average age of contracted units was 24.41 years, while price, floor area, and unit price were JPY 48.34 million (up 5.8%), 63.35 sqm (down 1.6%), and JPY 2.522 million per tsubo (up 7.5%), respectively. The unit price recorded the 49th consecutive month of increases on a YoY basis. The numbers of units newly listed and in inventory were 15,088 units (down 3.3% YoY), while 45,603 units (down 0.4% YoY), respectively, falling on a YoY basis for the first time in 28 months.

・A look at the numbers of contracts made and contracted prices per tsubo, respectively, by area shows respective increases of 4.0% and 8.6% in the Tokyo 23 wards and increases of 18.3% and 4.7% in suburban Tokyo, a decrease of 2.7% and an increase of 8.7% in Kanagawa Prefecture and increases of 8.9% and 5.3% in Saitama Prefecture and increases of 2.5% and 5.5% in Chiba Prefecture as the entire Tokyo metropolitan area experienced lively market activity.

■ Market overview

・In the newly built condominiums market, while supply continued to decrease in the Tokyo 23 wards, the average price and price per tsubo both remained high at JPY 103.26 million and JPY 5.369 million per tsubo, respectively. While the contract rate in the first month of sales fell to 42.7%, since in recent years many luxury condominiums have been sold over time to repeat buyers and referral clients , actual sales conditions appear to be stable for numerous properties.

・A look at the condominium market in the Kinki region shows a decrease in the city of Osaka, which accounted for the largest share of supply, and an increase in Osaka Prefecture. Properties now are being supplied in such areas as the cities of Kobe and Kyoto at unit prices of JPY 3 million or more, roughly equal to the level in the city of Osaka. This is due to signs of low demand and only fair contracting conditions, although market conditions appear to be improving overall.

・The numbers of second-hand condominiums listed and contracted are rising as supply decreases and prices rise for new condominiums. Market conditions are expected to continue to improve, thanks in part to such factors as the low supply of new properties near city centers and the fact that properties supplied around the year 2000 have reached the age at which they are more likely to be listed on the secondary market.

・Occupancy rates remain high in the apartment market due to short supplies, especially in central city. Demand from Japanese residents and inbound demand both are stable. This and high condominium prices are contributing to rising rent levels as increasing numbers of residents choose to rent.

Data: As for new supply = Real Estate Economic Institute Co., Ltd., and as for secondary market = Real Estate Information Network for East Japan

Office

Stable vacancy rates and rising rents, centered on existing office buildings, are apparent in Tokyo business districts, as the market rebounds. As numerous new office buildings scheduled to open (be completed) in 2024, competition is expected to intensify.

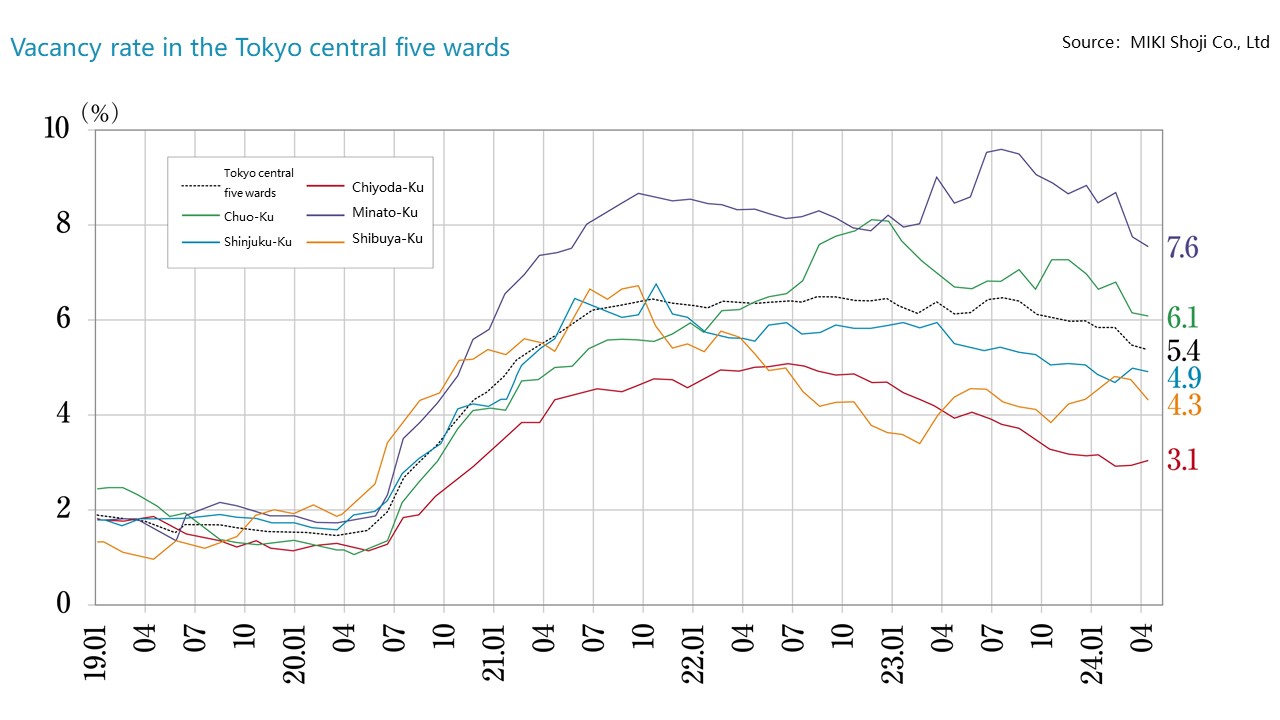

■ Large-scale office buildings in Tokyo CBD (Central 5 Wards)

・As of May 2024, the vacancy rate was up 0.10 ppt MoM to 5.48%, remaining below 6% since January 2024.

・Average rent was JPY 19,944 per tsubo, up JPY 119 MoM and JPY 67 YoY, recovering to the JPY 20,000 level.

・Rental floor space rose by 24,000 tsubo with the completion of three new buildings from April to May, to reach a total of 8,026,000 tsubo. The vacancy rate on new office buildings (those completed less than one year ago) remains high at 25.8%. While it is lower than the temporary rate of 30% in the past, challenging conditions continue as it takes time to close a contract.

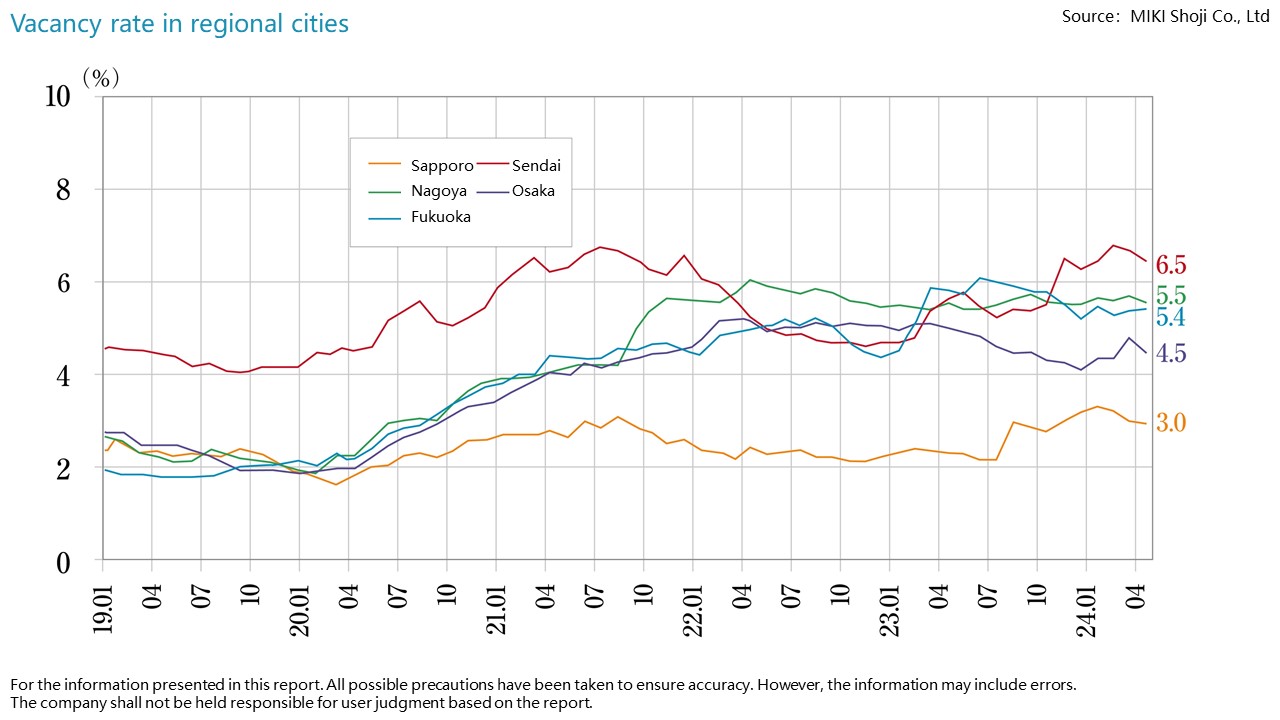

■ Vacancy rates, and movements in average rents in major regional cities / May 2024

・Sapporo: Vacancy @ 3.24% up 0.29 ppt MoM. Average rent @ JPY 10,418 per tsubo up JPY +45 MoM. (Vacancy rate worsened, while average rent increased.)

・Sendai: Vacancy @ 6.54% up 0.06 ppt MoM. Average rent @ JPY 9,361 per tsubo up JPY +5 MoM. (Vacancy rate changed little, while average rent increased slightly.)

・Yokohama: Vacancy @ 8.80% down 0.44 ppt MoM. Average rent @ JPY 12,779 per tsubo up JPY +14 MoM. (Vacancy rate improved, while average rent increased)

・Nagoya: Vacancy @ 5.63% up 0.09 ppt MoM. Average rent @ JPY 12,437 per tsubo up JPY +21 MoM. (Vacancy rate worsened slightly, while average rent increased.)

・Osaka: Vacancy @ 4.38% down 0.09 ppt MoM. Average rent @ JPY 12,097 per tsubo up JPY +36 MoM. (Vacancy rate changed little, while average rent increased.)

・Fukuoka: Vacancy unchanged @ 5.43%. Average rent @ JPY 11,673 per tsubo up JPY +25 MoM. (Vacancy rate unchanged, while average rent increased.) The vacancy rate shows a worsening trend, but the average rent increased in all areas because market conditions can be described as stable.

■ Current market analysis and future market outlook

・As increasing percentages of employees who are working in offices instead of working from home, demand appears to be growing with more cases of relocation from buildings planned for reconstruction and increases in floor space in currently occupied buildings, centered on existing large and medium-sized office buildings. On the other hand, the vacancy rate on new buildings has remained high over a lengthy period, and the challenges faced by new and large-scale properties with high rents are pronounced.

・There is a need to improve working environments through means such as adopting free-address floor plans, expanding meeting spaces, and enhancing security. This trend is also apparent among small- and medium-sized office buildings, and demand for improved office functions is expected to increase in the future as well.

・(Planned) supply of new offices in 2024 is 233,000 tsubo in 28 buildings in Tokyo business districts and 233,000 tsubo in nine buildings in Osaka business districts. The number of buildings and total floor space are slated to grow sharply from 2023 in the Osaka market, where supply is projected to reach its highest level since 1990.

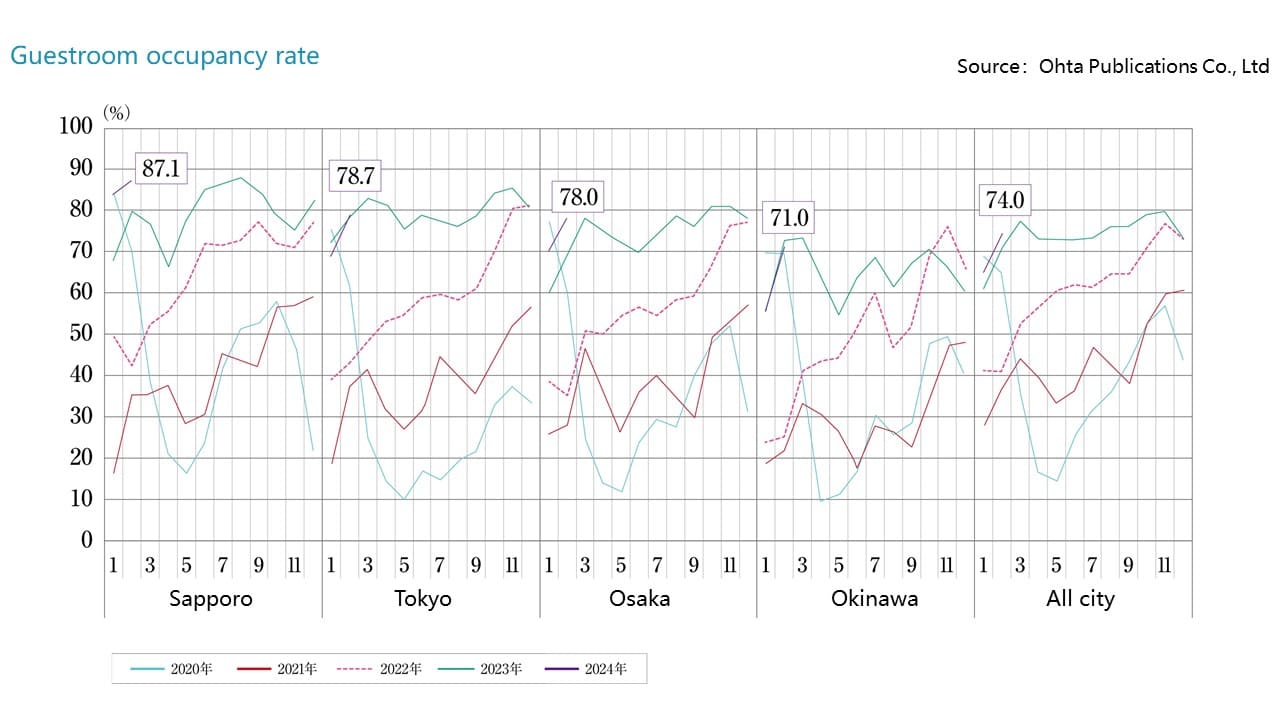

Hotels

As demand for lodging recovers to 50 million overnight stays per month, inbound tourists have increased sharply in number, benefiting from the devalued yen.

■ Numbers of guests are up thanks to sharp growth in inbound tourists

・In April 2024, the total number of overnight stays in Japan was 51.90 million (up by 10.1% YoY from 45.54 million). A breakdown shows 14.5 million overnight stays by foreign guests (up 46.9% YoY from 9.52 million) and 37.39 million by Japanese guests (up 0.3% YoY from 36.02 million). One year after COVID-19 moved to the status of a category-five infectious disease, lodging demand has recovered to and exceeded its pre-COVID level at 50 million overnight stays per month, and overnight stays by foreign visitors has reached a record high of more than 14 million.

■ Recent trends by category

・Overnight stays for each category largely increased YoY in all categories in April 2024 with so-called business hotels: 25.65 million nights (up 10.7% YoY), RYOKAN (Traditional Japanese Inn): 5.85 million nights (up 1.0% YoY), resort hotels : 5.59 million nights (up 1.3% YoY) and city hotels: 8.23 million nights (up 56.0% YoY). Growth at business hotels and inns was pronounced.

■ Inbound trends

・The top countries represented among the total number of visitors from overseas in April 2024 were China (1.786 million nights), Taiwan (1.42 million nights), South Korea (1.346 million nights), and the United States (1.413 million nights). A recovery in visitors from China can be considered one factor behind the growth in inbound tourism.

・In addition to the consumption of goods, the consumption of experiences, such as experiencing Japanese culture, accounts for an increasing share of sightseeing demand from inbound tourists (centered on those from Western countries in particular). As demand for accommodations grows in areas not recognized as sightseeing destinations before, global hotel brands are also advancing into the market.

■ Current market analysis and future market outlook

・The effects of the devalued yen and the "Cool Japan" strategy, among other factors related to inbound tourism, are stimulating economic activity, and hotel demand is expected to grow in the future as well. A change is apparent in guest attributes since COVID-19 as the numbers of Western travelers on lengthy stays increase. Hotel properties are being developed to meet a wide range of grades and lodging styles. Hotel operators, such as IHG, Hilton, Hyatt, Marriott, and Hoshino Resorts, plan new development projects, and Accor Hotels has opened 23 hotels rebranded from Daiwa Resorts. As these trends show, development of high-end hotels mainly targeting inbound tourism continues.

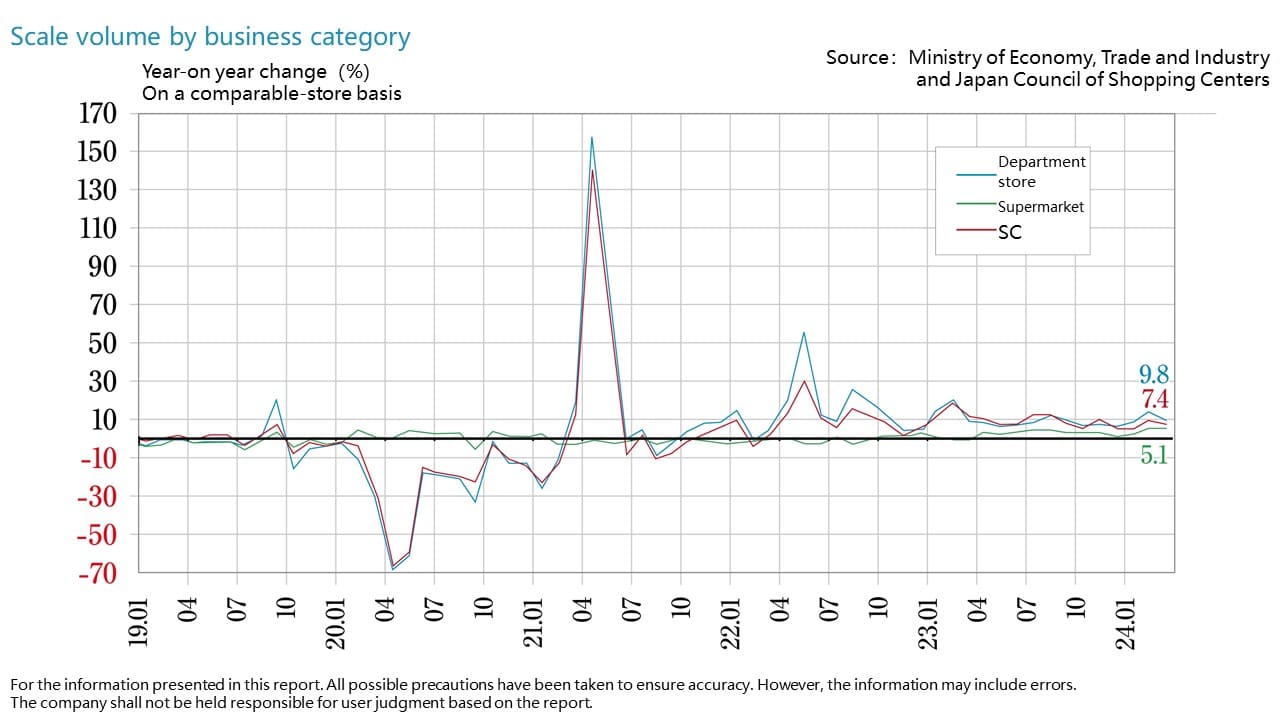

Commercial

Sales at department stores and shopping centers are growing sharply with increasing inbound consumption. To avoid weakening, local shops need to develop services not available in shopping centers.

■ Sales volume and status quo of shopping centers

・Existing store sales for shopping centers (overall) were approximately JPY 580.43 billion (up +4.8% YoY) in April 2024. Sales have remained up YoY since March 2022.Facilities whose sales increased as a result of favorable sales of high-end products thanks to growth in inbound tourism include shopping centers, department stores, and station buildings in the vicinities of major rail terminals where the customer base includes numerous travelers and office workers. Highly convenient major regional shopping centers also recorded strong performance thanks to sales-promotion efforts targeting seasonal leisure demand during the Golden Week holidays.

■ Future market outlook

・Inbound tourist spending in 2023 announced by the Japan Tourism Agency (final figures) showed a historical high of JPY 5,306.5 billion. A breakdown of demand shows a stronger trend toward focusing on experiences rather than shopping than was apparent in the previous survey. Spending on lodging accounted for 34.6% of the total, while that on shopping accounted for 26.5%, that on food and beverages 22.5%, and that on entertainment and services 5.1%.

・The number of new shopping centers opening in 2024 (including planned openings) is 20, of which four are located in Tokyo (three in the 23 wards and one in suburban Tokyo), three in Kanagawa Prefecture, and two each in Aichi and Osaka prefectures. Among developers, Aeon is developing four of the new shopping centers, while others are being developed by such players as Mitsui Fudosan, Chuden Real Estate, Tokyu Land, and Nomura Real Estate Development.

・Onward Kashiyama is developing eco-friendly discount stores that aim to contribute to the environment through reuse and recycling of its products. Fast Retailing has also launched a resale program in addition to its existing repurchasing program under the RE.UNIQLO brand. These and other efforts by manufacturers in response to growing demand for reuse of their products amid continuing inflation are notable.

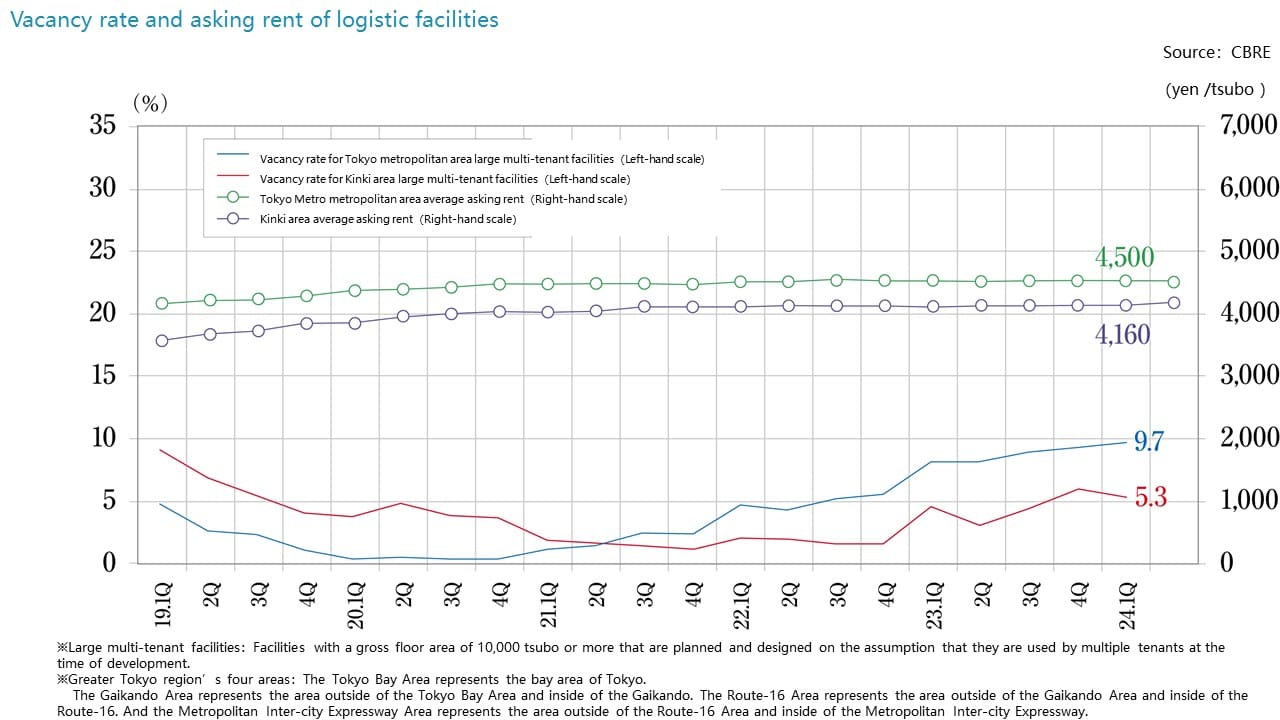

Logistics

The market for large-scale logistics facilities in the Tokyo metropolitan area, which has been growing with growing e-commerce market, shows a strengthening trend toward selectivity regarding locations, as some areas shows signs of oversupply.

■ Market conditions in the Tokyo metropolitan area and conditions by area

・In the Tokyo Bay area, the vacancy rate was 11.3% (down 0.8 ppt YoY), and rent was JPY 7,630 per tsubo (down 0.1%). The vacancy rate improved as vacancies decreased in existing facilities while rent fell slightly. It continues to take some time to fill vacancies.

・In the Tokyo Gaikan Expressway area, the vacancy rate was 4.4% (up 1.5 ppt), and rent was JPY 5,190 per tsubo (up 0.2 ppt). The vacancy rate was up due to new facilities. There are two new facilities construction plans in the area, and although rent remains firm, there are concerns about further increases in the vacancy rate.

・In the National Route 16 area, the vacancy rate was 9.6% (up 0.2 ppt), and rent was JPY 4,520 per tsubo (down 0.2%). Two of the six new facilities were completed with vacancies remaining. These combined with vacancies in existing properties led to a worsening of the vacancy rate. Rent conditions weakened in Chiba and Kanagawa prefectures.

・In the Metropolitan Intercity Expressway area, the vacancy rate was 13.7% (up 0.2 ppt), and rent was JPY 3,570 per tsubo (down 0.6%). Two of the three new facilities were completed with vacancies remaining. The vacancy rate is worsening as new demand of 36,000 tsubo could not fill available vacancies, and rent fell for the fourth consecutive quarter.

・Conditions of oversupply continue overall, although there is some variation by area. Despite strong underlying demand, new properties have been completed with vacancies in each area, and it is taking some time to conclude leases despite progress on price adjustments.

■ Market condition in other regions

・In the Kinki region, the vacancy rate was 5.3%, and the effective rent was JPY 4,160 per tsubo. Three new facilities have been filled steadily, and vacancies decreased in existing properties as well. New demand was 86,000 tsubo. Leasing is progressing on many new properties planned for supply in the future, and vacancy rates are improving. Rent levels are expected to continue to increase as well.

・In the Chubu region, the vacancy rate was 16.5%, and the effective rent was JPY 3,630 per tsubo. The vacancy rate rose because two buildings newly supplied were completed with space unleased. New properties in Nagoya are centered on the bayside area. It is taking some time to lease properties due to strong competition. While changes in rents are minor, rent increases are expected to become more likely.

・In the Fukuoka region, the vacancy rate was 4.9%, and the effective rent was JPY 3,470 per tsubo. Leasing is progressing smoothly on all four new facilities, and the vacancy rate improved sharply. The new supply of 69,000 tsubo is a record high, and demand from local logistics firms appears to be strong. The vacancy rate is expected to remain low, and the rent level to increase, in the future as well.

■ Future market outlook

・New supplies of space projected in 2Q 2024 through 1Q 2025 are approximately 620,000 tsubo in the Tokyo metropolitan area, 210,000 tsubo in the Kinki region, slightly less than 20,000 tsubo in the Chubu region, and slightly less than 50,000 tsubo in the Fukuoka region, respectively. While down from last year, oversupply and weakening rents appear to continue in the Tokyo metropolitan area. On the other hand, despite some differences in popularity by location demand in excess of supply is expected to push up rents in the Kinki, Chubu, and Fukuoka regions.

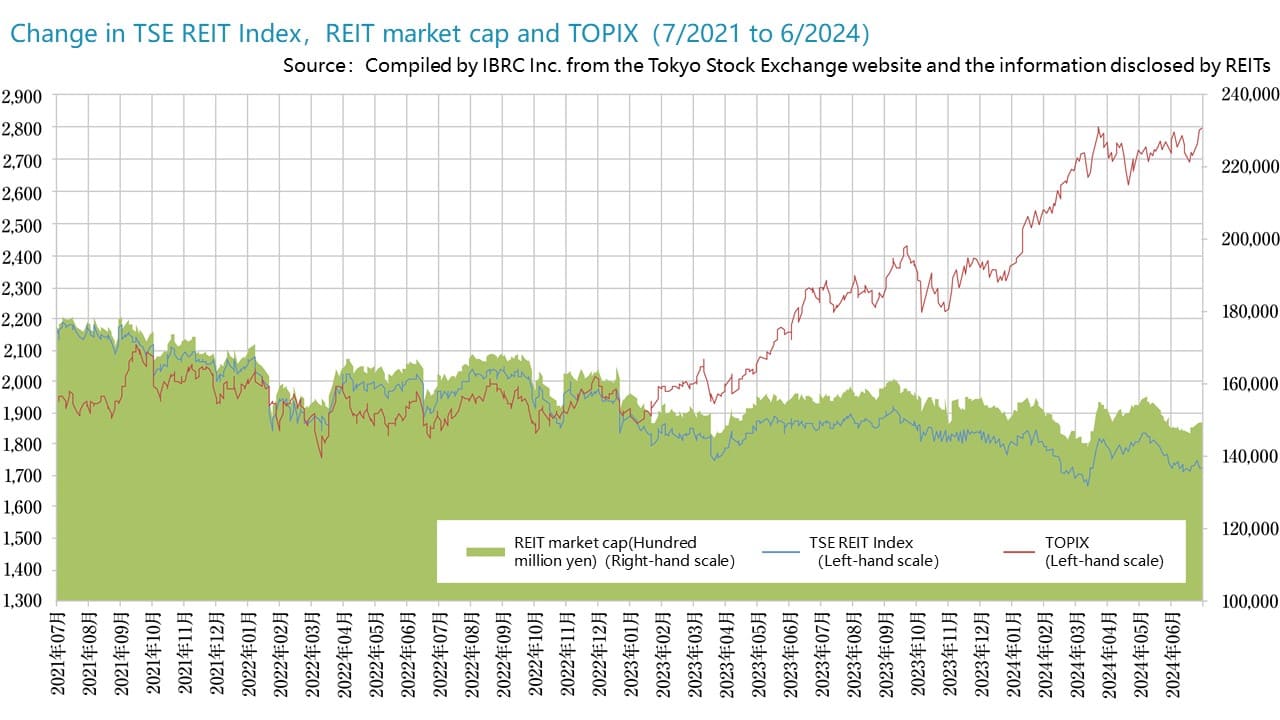

J-Reit

Despite a continuing downturn due in part to uncertainty about the BoJ monetary policy, cases are apparent of measures aiming at stability and enhancement of J-REIT issues.

■ J-REIT market trend

・At the end of May 2024, the TSE REIT index was 1,741.01, down 3.65% from the end of 2023, and market capitalization of all J-REITs was JPY 14.8859 trillion, down 3.41% from the end of 2023. A main factor behind the sluggish performance of the TSE REIT index while TOPIX was up 17.16% over the same period is growing expectations of interest-rate hikes as the BoJ is expected to shift course toward normalization of its monetary policy. There are concerns that rising interest rates could have a negative effect on REIT growth over the short term due to adjustments to real-estate prices, higher interest-payment costs, rising REIT dividend yields, and other factors.

・The aggregate AUM of J-REIT's grew by JPY 371.8 billion from 2023 year end to JPY 23.1879 trillion as of the end of May. However, transaction trends show pronounced differences by use. For example, while acquisition of residential and logistics properties was active, for office buildings and urban retail facilities, sales outweighed acquisitions.

・Low unit prices on the market are affecting REIT management as well. Only six REITs conducted POs in 1H 2024, down sharply from 12 in 1H 2023. At the same time, under conditions in which POs are challenging, REITs increasingly are realizing external growth while controlling fluctuations in investment unit prices through capital increases through third-party allocation to sponsors.

■ Status quo

・Some office REITs are improving the quality of their portfolios by the reshuffling of properties, including selling off offices that have become less profitable because of the loss of tenants and replacing them with newer properties acquired from sponsors and enhancing their earnings stability over the medium term by retaining gains from sale.

・There are also increasing cases of REITs acquiring their own investment units as part of their capital policies. The aim is to facilitate future growth by using some surplus on hand to acquire investment units at discounted price levels and increase dividends and net asset value (NAV) per investment unit by decreasing the number of units. In this way, REITs are implementing various measures under conditions in which it is difficult to achieve external growth.

お問い合わせ Contact us

まずは、お気軽にご相談ください。